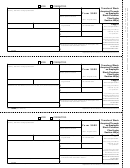

Form 3922 - Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Page 3

ADVERTISEMENT

CORRECTED

Transfer of Stock

CORPORATION'S name, street address, city or town, state or province,

1 Date option granted

OMB No. 1545-2129

country, and ZIP or foreign postal code

Acquired Through

Form 3922

an Employee

Stock Purchase

2 Date option exercised

Plan Under

(Rev. August 2013)

Section 423(c)

Copy B

CORPORATION'S federal identification number EMPLOYEE’S identification number

3 Fair market value per share

4 Fair market value per share

on grant date

on exercise date

For Employee

$

$

EMPLOYEE’S name

5 Exercise price paid per share

6 No. of shares transferred

This is important tax

information and is

$

being furnished to

Street address (including apt. no.)

7 Date legal title transferred

the Internal Revenue

Service.

City or town, state or province, country, and ZIP or foreign postal code

8 Exercise price per share determined as if the option was

exercised on the date shown in box 1.

Account number (see instructions)

$

3922

(keep for your records)

Form

(Rev. 8-2013)

Department of the Treasury - Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6