Form Pa-1000 - Instructions For Completing Your Claim Form - Property Tax Or Rent Rebate Program

ADVERTISEMENT

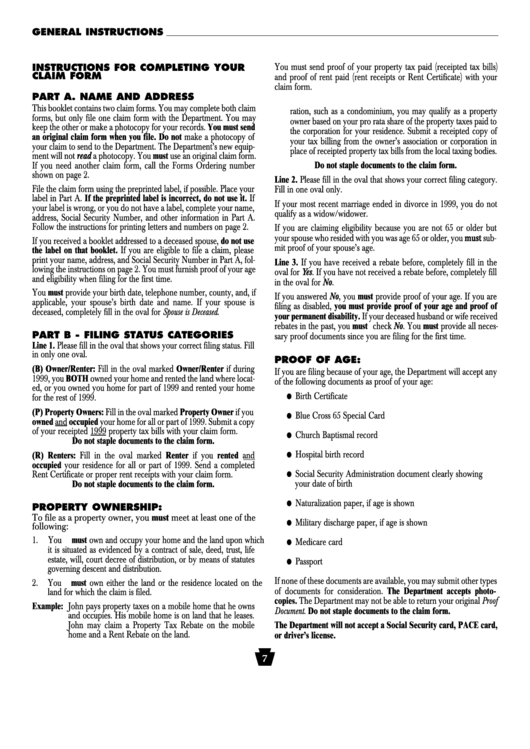

GENERAL INSTRUCTIONS

INSTRUCTIONS FOR COMPLETING YOUR

You must send proof of your property tax paid (receipted tax bills)

CLAIM FORM

and proof of rent paid (rent receipts or Rent Certificate) with your

claim form.

PART A. NAME AND ADDRESS

3. If you are a resident stockholder of a cooperative housing corpo-

This booklet contains two claim forms. You may complete both claim

ration, such as a condominium, you may qualify as a property

forms, but only file one claim form with the Department. You may

owner based on your pro rata share of the property taxes paid to

keep the other or make a photocopy for your records. You must send

the corporation for your residence. Submit a receipted copy of

an original claim form when you file. Do not make a photocopy of

your tax billing from the owner’s association or corporation in

your claim to send to the Department. The Department’s new equip-

place of receipted property tax bills from the local taxing bodies.

ment will not read a photocopy. You must use an original claim form.

Do not staple documents to the claim form.

If you need another claim form, call the Forms Ordering number

shown on page 2.

Line 2. Please fill in the oval that shows your correct filing category.

File the claim form using the preprinted label, if possible. Place your

Fill in one oval only.

label in Part A. If the preprinted label is incorrect, do not use it. If

If your most recent marriage ended in divorce in 1999, you do not

your label is wrong, or you do not have a label, complete your name,

qualify as a widow/widower.

address, Social Security Number, and other information in Part A.

Follow the instructions for printing letters and numbers on page 2.

If you are claiming eligibility because you are not 65 or older but

your spouse who resided with you was age 65 or older, you must sub-

If you received a booklet addressed to a deceased spouse, do not use

mit proof of your spouse’s age.

the label on that booklet. If you are eligible to file a claim, please

print your name, address, and Social Security Number in Part A, fol-

Line 3. If you have received a rebate before, completely fill in the

lowing the instructions on page 2. You must furnish proof of your age

oval for Yes. If you have not received a rebate before, completely fill

and eligibility when filing for the first time.

in the oval for No.

You must provide your birth date, telephone number, county, and, if

If you answered No, you must provide proof of your age. If you are

applicable, your spouse’s birth date and name. If your spouse is

filing as disabled, you must provide proof of your age and proof of

deceased, completely fill in the oval for Spouse is Deceased.

your permanent disability. If your deceased husband or wife received

rebates in the past, you must check No. You must provide all neces-

PART B - FILING STATUS CATEGORIES

sary proof documents since you are filing for the first time.

Line 1. Please fill in the oval that shows your correct filing status. Fill

in only one oval.

PROOF OF AGE:

(B) Owner/Renter: Fill in the oval marked Owner/Renter if during

If you are filing because of your age, the Department will accept any

1999, you BOTH owned your home and rented the land where locat-

of the following documents as proof of your age:

ed, or you owned you home for part of 1999 and rented your home

Birth Certificate

for the rest of 1999.

(P) Property Owners: Fill in the oval marked Property Owner if you

Blue Cross 65 Special Card

owned and occupied your home for all or part of 1999. Submit a copy

of your receipted 1999 property tax bills with your claim form.

Church Baptismal record

Do not staple documents to the claim form.

(R) Renters: Fill in the oval marked Renter if you rented and

Hospital birth record

occupied your residence for all or part of 1999. Send a completed

Social Security Administration document clearly showing

Rent Certificate or proper rent receipts with your claim form.

Do not staple documents to the claim form.

your date of birth

Naturalization paper, if age is shown

PROPERTY OWNERSHIP:

To file as a property owner, you must meet at least one of the

Military discharge paper, if age is shown

following:

You must own and occupy your home and the land upon which

1.

Medicare card

it is situated as evidenced by a contract of sale, deed, trust, life

estate, will, court decree of distribution, or by means of statutes

Passport

governing descent and distribution.

2. You must own either the land or the residence located on the

If none of these documents are available, you may submit other types

of documents for consideration. The Department accepts photo-

land for which the claim is filed.

copies. The Department may not be able to return your original Proof

Example: John pays property taxes on a mobile home that he owns

Document. Do not staple documents to the claim form.

and occupies. His mobile home is on land that he leases.

The Department will not accept a Social Security card, PACE card,

John may claim a Property Tax Rebate on the mobile

or driver’s license.

home and a Rent Rebate on the land.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4