Instructions

A South Dakota Estate Tax Return must be filed when a resident decedent’s total “gross” estate is equal

to or in excess of the minimum which requires the filing of a federal estate tax return. The same

requirement applies to the estate of a nonresident decedent who owned real or tangible personal property

in South Dakota. Real property includes mineral interests.

The South Dakota estate tax is a pickup tax based upon the credit for state death taxes as computed on

the federal estate tax return. The information from the federal estate tax return is required to complete

the South Dakota Estate Tax Return.

The following documents must accompany the South Dakota Estate Tax Return:

1. A copy of the signed and dated federal estate tax return, including all schedules.

2. A copy of the Will, Trust, and/or other governing instruments.

3. Copies of the appraisals upon which the real property values are based.

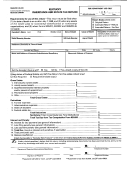

Part 1. Decedent and Personal Representative

Complete the top portion of the form. Note: If the decedent’s property was jointly owned with a surviving

spouse or other heir and no personal representative was appointed, enter the name and address of the surviving

joint tenant under Number 6 “Name and address of personal representative or applicant.”

Part 2. Computation of Tax

Line 1: Enter the total “gross” estate from the Federal Form 706. For estates of nonresident decedents, do not

enter just the percentage of property located in South Dakota on this line.

Line 2: Enter the total “gross” values of the decedent’s property which has taxable situs in South Dakota.

Line 3: Calculate the percentage of the decedent’s gross estate that has taxable situs in South Dakota by

dividing line 2 by line 1, to four decimal places, i.e. 0.4321.

Line 4: Enter the total credit for state death taxes from Federal Form 706.

Line 5: Multiply line 4 by line 3.

Line 6: Enter interest, if any. Estate tax is due one year after date of death. Interest accrues at 10% per

year calculated on a daily basis. SDCL 54-3-16.

Payments should be made payable to SD State Treasurer and sent to:

Remittance Processing Center, PO BOX 5055, Sioux Falls, SD 57117-5055

Please mail the Estate Tax Return to:

SD Department of Revenue, 445 East Capitol Avenue, Pierre, SD 57501-3100

PRINT FOR MAILING

CLEAR FORM

1.

1

1 2

2