Electronic Funds Transfers "Eft" - Sales Tax Fact Sheet 159

ADVERTISEMENT

Electronic Funds Transfers

Sales Tax Fact Sheet 159

“EFT”

There are three types of EFT payers with different meth-

Mandatory EFT payers

ods and dates for payments. This fact sheet explains these

Estimated payments. If you don’t have the actual

differences and methods of payment.

figures for a mandatory account ready by the 14th you

must make an estimated payment. The estimated payment

Even though you make payments electronically, you must

must be one of the following:

still file the paper State and City Sales and Use Tax Re-

100 percent of the previous month’s liability,

turns.

100 percent of the same period one year ago, or

Calendars are available for each type of EFT. Call 651-

95 percent of the actual liability.

282-9822 to request a calendar if you didn’t receive one.

The balance is due on the 25th of the month. You must

Types of EFT

also make this payment electronically. If there is an over-

payment of tax, we will issue a refund. Do not take credit

Mandatory EFT payers - These accounts are required

on any other return for an overpayment.

by law to pay sales and use tax electronically because

their sales and use tax was more than $120,000 in the

June estimate. Mandatory EFT payers must make a

previous state fiscal year.

June estimated payment two business days before the

end of June. Penalty will be assessed unless the estimated

Associated EFT payers - If a taxpayer is required to

payment is one of the following:

pay any business tax type to the Department of Revenue

75 percent of the May liability,

by EFT, the taxpayer must pay all business taxes by EFT.

75 percent of the average calendar year liability, or

Voluntary EFT payers - These taxpayers have asked

75 percent of the actual June liability.

to pay their sales and use tax by EFT.

The balance of the June liability is due August 14th and

The Department of Revenue notifies taxpayers that must

the June return is due on August 25th. There is no form to

pay by EFT (mandatory and associated payers).

mail in when you make the June estimated payment.

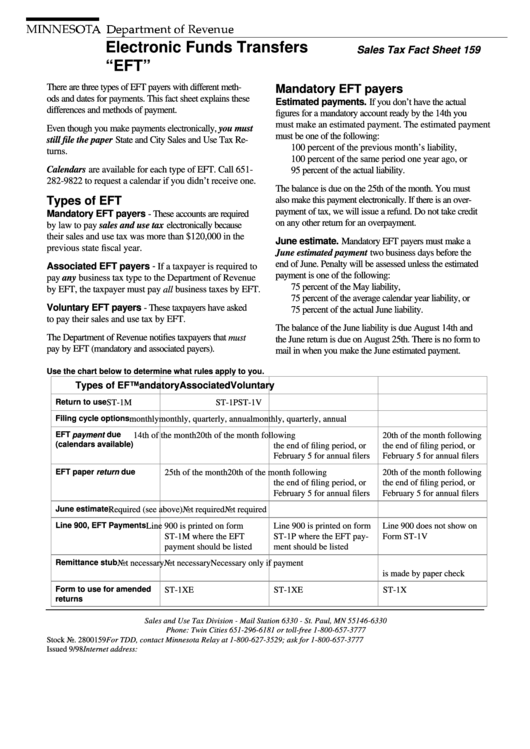

Use the chart below to determine what rules apply to you.

Types of EFT

Mandatory

Associated

Voluntary

Return to use

ST-1M

ST-1P

ST-1V

Filing cycle options

monthly

monthly, quarterly, annual

monthly, quarterly, annual

EFT payment due

14th of the month

20th of the month following

20th of the month following

(calendars available)

the end of filing period, or

the end of filing period, or

February 5 for annual filers

February 5 for annual filers

EFT paper return due

25th of the month

20th of the month following

20th of the month following

the end of filing period, or

the end of filing period, or

February 5 for annual filers

February 5 for annual filers

June estimate

Required (see above)

Not required

Not required

Line 900, EFT Payments

Line 900 is printed on form

Line 900 is printed on form

Line 900 does not show on

ST-1M where the EFT

ST-1P where the EFT pay-

Form ST-1V

payment should be listed

ment should be listed

Remittance stub

Not necessary

Not necessary

Necessary only if payment

is made by paper check

Form to use for amended

ST-1XE

ST-1XE

ST-1X

returns

Sales and Use Tax Division - Mail Station 6330 - St. Paul, MN 55146-6330

Phone: Twin Cities 651-296-6181 or toll-free 1-800-657-3777

Stock No. 2800159

For TDD, contact Minnesota Relay at 1-800-627-3529; ask for 1-800-657-3777

Issued 9/98

Internet address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2