Form Wh-1601 - Withholding Tax Coupon

ADVERTISEMENT

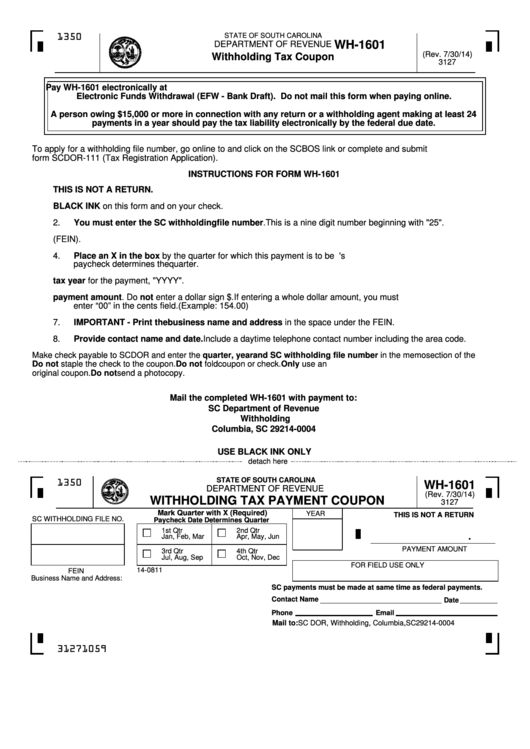

STATE OF SOUTH CAROLINA

1350

WH-1601

DEPARTMENT OF REVENUE

(Rev. 7/30/14)

Withholding Tax Coupon

3127

Pay WH-1601 electronically at Click on DOR ePay and pay with VISA or MasterCard or by

Electronic Funds Withdrawal (EFW - Bank Draft). Do not mail this form when paying online.

A person owing $15,000 or more in connection with any return or a withholding agent making at least 24

payments in a year should pay the tax liability electronically by the federal due date.

To apply for a withholding file number, go online to and click on the SCBOS link or complete and submit

form SCDOR-111 (Tax Registration Application).

INSTRUCTIONS FOR FORM WH-1601

THIS IS NOT A RETURN.

1.

Only use BLACK INK on this form and on your check.

2.

You must enter the SC withholding file number. This is a nine digit number beginning with "25".

3.

Enter the Federal Employer Identification Number (FEIN).

4.

Place an X in the box by the quarter for which this payment is to be applied. The date on the employee's

paycheck determines the quarter.

5.

Enter the tax year for the payment, "YYYY".

6.

Enter the payment amount. Do not enter a dollar sign $. If entering a whole dollar amount, you must

enter “00” in the cents field. (Example: 154.00)

7.

IMPORTANT - Print the business name and address in the space under the FEIN.

8.

Provide contact name and date. Include a daytime telephone contact number including the area code.

Make check payable to SCDOR and enter the quarter, year and SC withholding file number in the memo section of the

check. Coupon must accompany payment. Do not staple the check to the coupon. Do not fold coupon or check. Only use an

original coupon. Do not send a photocopy.

Mail the completed WH-1601 with payment to:

SC Department of Revenue

Withholding

Columbia, SC 29214-0004

USE BLACK INK ONLY

detach here

STATE OF SOUTH CAROLINA

1350

WH-1601

DEPARTMENT OF REVENUE

(Rev. 7/30/14)

WITHHOLDING TAX PAYMENT COUPON

3127

Mark Quarter with X (Required)

YEAR

THIS IS NOT A RETURN

SC WITHHOLDING FILE NO.

Paycheck Date Determines Quarter

1st Qtr

2nd Qtr

.

Jan, Feb, Mar

Apr, May, Jun

PAYMENT AMOUNT

3rd Qtr

4th Qtr

Jul, Aug, Sep

Oct, Nov, Dec

FOR FIELD USE ONLY

14-0811

FEIN

Business Name and Address:

SC payments must be made at same time as federal payments.

Contact Name

Date

Phone

Email

Mail to: SC DOR, Withholding, Columbia, SC 29214-0004

31271059

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4