Form 150-102-022 - Oregon Estimated Tax Worksheet - 1999

ADVERTISEMENT

O

1999

regon

Form 20ES Instructions

Estimated Corporation Excise or Income Tax

What’s new?

What is estimated tax?

In most cases, estimated tax is the amount of tax you expect

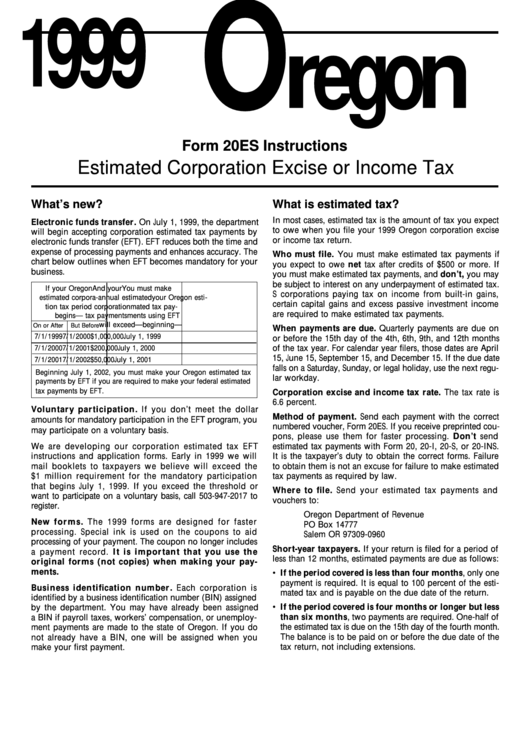

Electronic funds transfer. On July 1, 1999, the department

to owe when you file your 1999 Oregon corporation excise

will begin accepting corporation estimated tax payments by

or income tax return.

electronic funds transfer (EFT). EFT reduces both the time and

expense of processing payments and enhances accuracy. The

Who must file. You must make estimated tax payments if

chart below outlines when EFT becomes mandatory for your

you expect to owe net tax after credits of $500 or more. If

business.

you must make estimated tax payments, and don’t, you may

be subject to interest on any underpayment of estimated tax.

If your Oregon

And your

You must make

S corporations paying tax on income from built-in gains,

estimated corpora-

annual estimated

your Oregon esti-

certain capital gains and excess passive investment income

tion tax period

corporation

mated tax pay-

are required to make estimated tax payments.

begins—

tax payments

ments using EFT

will exceed—

beginning—

On or After

But Before

When payments are due. Quarterly payments are due on

7/1/1999 7/1/2000

$1,000,000

July 1, 1999

or before the 15th day of the 4th, 6th, 9th, and 12th months

7/1/2000 7/1/2001

$200,000

July 1, 2000

of the tax year. For calendar year filers, those dates are April

15, June 15, September 15, and December 15. If the due date

7/1/2001 7/1/2002

$50,000

July 1, 2001

falls on a Saturday, Sunday, or legal holiday, use the next regu-

Beginning July 1, 2002, you must make your Oregon estimated tax

lar workday.

payments by EFT if you are required to make your federal estimated

tax payments by EFT.

Corporation excise and income tax rate. The tax rate is

6.6 percent.

Voluntary participation. If you don’t meet the dollar

Method of payment. Send each payment with the correct

amounts for mandatory participation in the EFT program, you

numbered voucher, Form 20ES. If you receive preprinted cou-

may participate on a voluntary basis.

pons, please use them for faster processing. Don’t send

We are developing our corporation estimated tax EFT

estimated tax payments with Form 20, 20-I, 20-S, or 20-INS.

instructions and application forms. Early in 1999 we will

It is the taxpayer’s duty to obtain the correct forms. Failure

mail booklets to taxpayers we believe will exceed the

to obtain them is not an excuse for failure to make estimated

$1 million requirement for the mandatory participation

tax payments as required by law.

that begins July 1, 1999. If you exceed the threshold or

Where to file. Send your estimated tax payments and

want to participate on a voluntary basis, call 503-947-2017 to

vouchers to:

register.

Oregon Department of Revenue

New forms. The 1999 forms are designed for faster

PO Box 14777

processing. Special ink is used on the coupons to aid

Salem OR 97309-0960

processing of your payment. The coupon no longer includes

Short-year taxpayers. If your return is filed for a period of

a payment record. It is important that you use the

less than 12 months, estimated payments are due as follows:

original forms (not copies) when making your pay-

ments.

• If the period covered is less than four months, only one

payment is required. It is equal to 100 percent of the esti-

Business identification number. Each corporation is

mated tax and is payable on the due date of the return.

identified by a business identification number (BIN) assigned

• If the period covered is four months or longer but less

by the department. You may have already been assigned

than six months, two payments are required. One-half of

a BIN if payroll taxes, workers’ compensation, or unemploy-

the estimated tax is due on the 15th day of the fourth month.

ment payments are made to the state of Oregon. If you do

not already have a BIN, one will be assigned when you

The balance is to be paid on or before the due date of the

tax return, not including extensions.

make your first payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4