Form It-20np - Consumer'S Use Tax Worksheet For Line 19

ADVERTISEMENT

to report gross receipts and unrelated business income subject

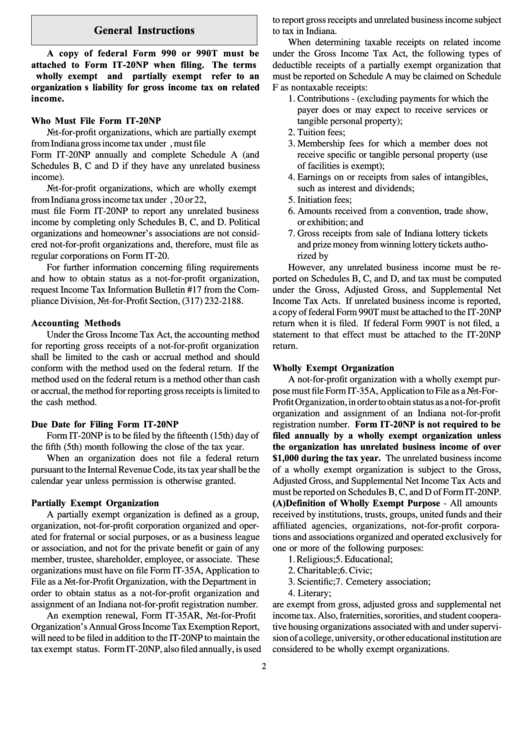

General Instructions

to tax in Indiana.

When determining taxable receipts on related income

A copy of federal Form 990 or 990T must be

under the Gross Income Tax Act, the following types of

attached to Form IT-20NP when filing.

The terms

deductible receipts of a partially exempt organization that

“wholly exempt” and “partially exempt” refer to an

must be reported on Schedule A may be claimed on Schedule

organization’s liability for gross income tax on related

F as nontaxable receipts:

income.

1.

Contributions - (excluding payments for which the

payer does or may expect to receive services or

Who Must File Form IT-20NP

tangible personal property);

Not-for-profit organizations, which are partially exempt

2.

Tuition fees;

from Indiana gross income tax under I.C. 6-2.1-3-21, must file

3.

Membership fees for which a member does not

Form IT-20NP annually and complete Schedule A (and

receive specific or tangible personal property (use

Schedules B, C and D if they have any unrelated business

of facilities is exempt);

income).

4.

Earnings on or receipts from sales of intangibles,

Not-for-profit organizations, which are wholly exempt

such as interest and dividends;

from Indiana gross income tax under I.C. 6-2.1-3-19, 20 or 22,

5.

Initiation fees;

must file Form IT-20NP to report any unrelated business

6.

Amounts received from a convention, trade show,

income by completing only Schedules B, C, and D. Political

or exhibition; and

organizations and homeowner’s associations are not consid-

7.

Gross receipts from sale of Indiana lottery tickets

ered not-for-profit organizations and, therefore, must file as

and prize money from winning lottery tickets autho-

regular corporations on Form IT-20.

rized by I.C. 4-30.

For further information concerning filing requirements

However, any unrelated business income must be re-

and how to obtain status as a not-for-profit organization,

ported on Schedules B, C, and D, and tax must be computed

request Income Tax Information Bulletin #17 from the Com-

under the Gross, Adjusted Gross, and Supplemental Net

pliance Division, Not-for-Profit Section, (317) 232-2188.

Income Tax Acts. If unrelated business income is reported,

a copy of federal Form 990T must be attached to the IT-20NP

Accounting Methods

return when it is filed. If federal Form 990T is not filed, a

Under the Gross Income Tax Act, the accounting method

statement to that effect must be attached to the IT-20NP

for reporting gross receipts of a not-for-profit organization

return.

shall be limited to the cash or accrual method and should

Wholly Exempt Organization

conform with the method used on the federal return. If the

method used on the federal return is a method other than cash

A not-for-profit organization with a wholly exempt pur-

or accrual, the method for reporting gross receipts is limited to

pose must file Form IT-35A, Application to File as a Not-For-

the cash method.

Profit Organization, in order to obtain status as a not-for-profit

organization and assignment of an Indiana not-for-profit

Due Date for Filing Form IT-20NP

registration number. Form IT-20NP is not required to be

filed annually by a wholly exempt organization unless

Form IT-20NP is to be filed by the fifteenth (15th) day of

the organization has unrelated business income of over

the fifth (5th) month following the close of the tax year.

$1,000 during the tax year. The unrelated business income

When an organization does not file a federal return

pursuant to the Internal Revenue Code, its tax year shall be the

of a wholly exempt organization is subject to the Gross,

calendar year unless permission is otherwise granted.

Adjusted Gross, and Supplemental Net Income Tax Acts and

must be reported on Schedules B, C, and D of Form IT-20NP.

Partially Exempt Organization

(A) Definition of Wholly Exempt Purpose - All amounts

A partially exempt organization is defined as a group,

received by institutions, trusts, groups, united funds and their

organization, not-for-profit corporation organized and oper-

affiliated agencies, organizations, not-for-profit corpora-

ated for fraternal or social purposes, or as a business league

tions and associations organized and operated exclusively for

or association, and not for the private benefit or gain of any

one or more of the following purposes:

member, trustee, shareholder, employee, or associate. These

1. Religious;

5. Educational;

organizations must have on file Form IT-35A, Application to

2. Charitable;

6. Civic;

File as a Not-for-Profit Organization, with the Department in

3. Scientific;

7. Cemetery association;

order to obtain status as a not-for-profit organization and

4. Literary;

assignment of an Indiana not-for-profit registration number.

are exempt from gross, adjusted gross and supplemental net

An exemption renewal, Form IT-35AR, Not-for-Profit

income tax. Also, fraternities, sororities, and student coopera-

Organization’s Annual Gross Income Tax Exemption Report,

tive housing organizations associated with and under supervi-

will need to be filed in addition to the IT-20NP to maintain the

sion of a college, university, or other educational institution are

tax exempt status. Form IT-20NP, also filed annually, is used

considered to be wholly exempt organizations.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7