Form Ct-1120 Att - Connecticut Corporation Business Tax Return Attachment Schedules H, I, And J - 2014 Page 2

ADVERTISEMENT

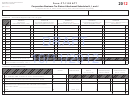

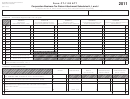

Schedule I

–

Dividend Deduction

Column A

Column B

Column C

Column D

Column E

Amount

Deduction Rate

Balance

Related Expenses

Dividend Deduction

(Col. A x Col. B)

Attach schedule.

(Col. C – Col. D)

1. Dividend income included in computation of federal taxable income

from Form CT-1120, Schedule D, Line 1: See instructions.

00

70% ( .70 )

2. Dividends from domestic corporations less than 20% owned

00

00

00

100% ( 1.0 )

3. Dividend balance: Subtract Line 2 from Line 1.

00

00

00

4. Dividends from a Captive REIT that is taxable in Connecticut

Captive REIT Name:

_________________________________________

100% ( 1.0 )

FEIN:

00

______________________________________________________

00

00

5. Total dividend deduction: Add Lines 2, 3, and 4 in Column E. Enter the result here and on Form CT-1120, Schedule D, Line 11.

00

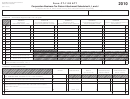

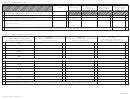

Schedule J

Bonus Depreciation Recovery

–

Column A

Column B

Column C

Assets Subject to IRC §168(k)

2014 MACRS Depreciation on Federal Basis

2014 MACRS Depreciation on Connecticut Basis

2014 Recovery of IRC §168(k)

Placed in Service During Income Year

(after IRC §168(k) Bonus)

(without IRC §168(k) Bonus)

Bonus Depreciation (Col. B – Col. A)

2000

00

00

00

1.

2001

00

00

00

2.

2002

00

00

00

3.

2003

00

00

00

4.

2004

00

00

00

5.

2005

6.

00

00

00

No bonus depreciation was available for 2006

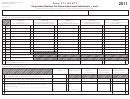

2007

00

00

00

7.

2008

00

00

00

8.

2009

00

00

00

9.

2010

00

00

00

10.

2011

00

00

00

11.

2012

00

00

00

12.

2013

00

00

00

13.

2014

00

00

00

14.

00

15. Federal bonus depreciation recovery: Add Lines 1 through 14, in Column C. Enter the result here and on Form CT-1120, Schedule D, Line 14.

Page 2 of 3

Form CT-1120 ATT (Rev. 12/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3