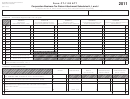

Form Ct-1120 Att - Connecticut Corporation Business Tax Return Attachment Schedules H, I, And J - 2014 Page 3

ADVERTISEMENT

Form CT-1120 ATT Instructions

Complete this form in blue or black ink only.

Line 3 - Dividend Balance: Subtract Line 2 from Line 1

Lines 1 through 14 - These lines are used to account

and enter the result on Line 3, Column A. Multiply

for any qualifying assets placed in service during the

Form CT-1120 ATT must be attached to Form

Column A by Column B (100%) and enter the result in

corporation’s income year(s) for which the bonus

CT-1120, Corporation Business Tax Return, whenever

Column C. Enter in Column D related expenses. Attach

depreciation under IRC §168(k) is claimed on federal

Schedule H, Schedule I, or Schedule J, is used in the

a schedule of related expenses and computation.

Form 4562.

calculation of the Connecticut corporation business

Subtract Column D from Column C and enter the

Enter in Column A the amount of Modifi ed Accelerated

tax.

result in Column E.

Cost Recovery System (MACRS) depreciation claimed

Schedule H – Connecticut Apportioned

by the corporation on its federal Form 4562 with

Line 4 - Enter in Column A dividends from a Captive

Operating Loss Carryover

respect to those qualifying assets.

Real Estate Investment Trust (Captive REIT) taxable

Lines 1 through 15 - Enter the amount of the

in Connecticut. This deduction will be allowed only

Enter in Column B the amount of MACRS depreciation

Connecticut apportioned operating income loss

if the Captive REIT’s name and Federal Employer

allowed on those same assets for Connecticut

carryover from the preceding income years as

Identifi cation Number (FEIN) are also entered. Multiply

corporation business tax purposes for the income

reported on Form CT-1120 fi led for those years. Net

Column A by Column B (100%) and enter the result in

year. Connecticut depreciation is determined under

operating losses incurred in income years beginning

Column C. Enter in Column D related expenses. Attach

the Internal Revenue Code of 1986 without regard to

on or after January 1, 2000, may be carried forward

a schedule of related expenses and computation.

IRC §168(k).

for 20 successive income years.

Subtract Column D from Column C and enter the

Enter in Column C the difference between the amount

result in Column E. See Informational Publication

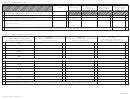

Line 16 - Add Lines 1 through 14 in Column D and

claimed in Column B and the amount claimed in

2010(21), Corporation Business Tax Application to

enter the total. Enter the amount from Column D on

Column A.

Real Estate Investment Trusts (REITs) and Owners

Form CT-1120, Schedule A, Line 4.

Line 15 - Add Lines 1 through 14 in Column C. Enter

of REITs.

Line 17 - Add Lines 1 through 15 in Column E and

the total here and on Form CT-1120, Schedule D,

Line 5 - Enter in Column E total dividend deduction.

enter the total on Line 17, Column E.

Line 14.

Add Lines 2, 3, and 4, Column E. Enter the total here

Schedule I – Dividend Deduction

and on Form CT-1120, Schedule D, Line 11.

Line 1 - Enter in Column A total dividend income

Schedule J – Bonus Depreciation Recovery

included in the computation of federal taxable

Complete Schedule J if the corporation claimed

income, except for dividends received from a real

the bonus depreciation under IRC §168(k) for

estate investment trust, unless those dividends are:

qualifying property, on its federal Form 4562,

1) deductible under IRC §243; or 2) received by a

Depreciation and Amortization. For purposes of

qualifi ed dividend recipient from a qualifi ed real estate

the Connecticut corporation business tax, the

investment trust.

special deduction permitted under IRC §168(k) is

Line 2 - Enter in Column A dividends from less than

not allowed and depreciation must be calculated

20% owned domestic corporations, which would

without regard to IRC §168(k). Schedule J is used

include dividends from money market funds. The

to account for the subtraction modification that

deduction is limited to 70% of gross dividends less

must be made to federal net income (loss). See

related expenses. Multiply Column A by Column B

Special Notice 2002(10), Bonus Depreciation for

(70%) and enter the result in Column C. Enter in

Connecticut Corporation Business Tax Purposes

Column D related expenses. Attach a schedule of

and Announcement 2008(7), Stimulus Depreciation

related expenses and computation. Subtract Column

and Special Instructions for Stimulus Depreciation

D from Column C and enter the result in Column E.

Claimed by Non-Calendar Year Filers of the 2007

Connecticut Corporation Business Tax Return.

Page 3 of 3

Form CT-1120 ATT (Rev. 12/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3