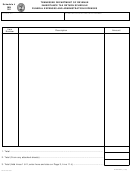

SCHEDULES

Date of Valuation of assets (check one): Value of assets at date of death

or Value of assets 6 months after date of death

SCHEDULE A - REAL ESTATE

SCHEDULE B - PERSONAL & MISC. PROPERTY

Individually owned and located in Tennessee

Cash, Notes, Mortgages, Life Insurance, Stocks, Bonds, Annuities, Furnishings,

Automobiles, Jewelry, etc. Owned Individually

Description & Location

Full Value

Description

Full Value

$

11. TOTAL (enter on front, Line 2)

$

10. TOTAL (enter on front, Line 1)

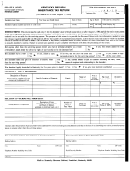

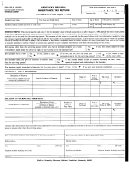

SCHEDULE C (PART 1) - JOINTLY OWNED PROPERTY

List property interest held jointly by decedent and spouse

Description

Full Value

12. Total Property Value

$

13. One-half (½ ) of Line 12

SCHEDULE C (PART 2) - JOINTLY OWNED PROPERTY

List property interests held jointly by decedent and persons other than spouse

Description

% owned by Decedent

Name of Joint Owner

Full Value Owned by Decedent

14. Total Property Value

$

15. Total of lines 13 & 14 (enter on front, Line 3)

SCHEDULE D - TRANSFERS DURING DECEDENT'S LIFE

List all transfers made by decedent within 3 years prior to date of death

Description of Transfer

To Whom (name)

Date of Gift

Full Value

16. Total Gifts

17. Gift Tax Paid (enter total of State Gift Tax paid on above gifts)

18. Total of lines 16 & 17 (enter on front, Line 4)

$

SCHEDULE E - DEDUCTIONS

Examples: funeral & burial expenses, administrative expenses (court costs, bonds, etc.) professional fees (attorney, accountant, etc.) taxes (property, individual, etc.), notes

& mortgages due (decedent obligations but only ½ of joint obligations), debts of decedent (unpaid at date of death), bequests (public, charitable, religious, & educational),

marital deductions (list all property passing to spouse), etc.

Description

Amount

$

19. TOTAL AMOUNT ALL DEDUCTIONS (enter on front, Line 8)

INTERNET (8-11)

1

1 2

2