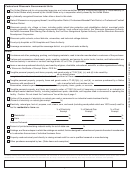

Form S-211 - Wisconsin Sales And Use Tax Exemption Certificate Page 4

ADVERTISEMENT

A similar out-of-state organization, generally organized

Other purchases exempted by law include:

under sec. 501(c)(3) of the Internal Revenue Code, may

1. Printed material which is designed to advertise and

purchase products or services exempt from Wisconsin sales

promote the sale of merchandise, or to advertise the

tax even though it has not been issued a CES number. This

services of individual business firms, which printed

exemption does not apply to out-of-state public schools,

material is purchased and stored for the purpose of

including public colleges and universities, and governmental

subsequently transporting it outside the state by the

units from other states.

purchaser for use thereafter solely outside the state.

Purchases (for lodging, meals, auto rental, etc.) by

2. Parts, supplies, or repairs for a school bus used exclu-

employees/representatives

of

exempt

organizations

sively as a contract carrier pursuant to a contract with a

performing organization business, are exempt from sales

school or other organization.

tax, provided 1) the retailer issues the billing or invoice in

3. Waste reduction and recycling machinery and equipment,

the name of the exempt organization, 2) the CES number is

including parts and repairs, which are exclusively and

entered on the billing or invoice, and 3) the retailer retains a

directly used for waste reduction and recycling activities.

copy of that document.

4. Railway cars, locomotives, and other rolling stock used in

Waste treatment facilities: The exemption applies to the

railroad operations, or accessories, attachments, parts,

sale of tangible personal property and items and property un-

lubricants, or fuel therefor.

der s.77.52(1)(b) and (c) to a contractor for incorporation into

real property which is part of an industrial or commercial waste

5. Commercial vessels and barges of 50-ton burden or over

treatment facility that qualifies for property tax exemption or

engaged in interstate or foreign commerce or commercial

fishing, and accessories, attachments, parts, and fuel

a Wisconsin or federal governmental waste treatment facility.

therefor.

Electricity, natural gas, fuel oil, coal, steam, corn, and

6. Fuel sold for use in motorboats that are regularly em-

wood (including wood pellets which are 100% wood)

ployed in carrying persons for hire for sport fishing in and

used for fuel:

upon the outlying waters, as defined in sec. 29.001(63),

• The sales price from the sale of electricity and natural gas

Wis. Stats., and the rivers and tributaries specified in

sec. 29.2285(2)(a)1. and 2., Wis. Stats., if the owner and

for residential use during the months of November through

April are exempt from sales and use tax.

all operators are licensed under sec. 29.514, Wis. Stats.,

• The sales price from sales of fuel oil, propane, coal, steam,

to operate the boat for that purpose.

corn, and wood (including wood pellets which are 100%

7. A product whose power source is the wind, direct radiant

wood) used for fuel sold for residential use are exempt

energy received from the sun, or gas generated by the

from sales or use tax. Wood pellets are considered 100%

anaerobic digestion of animal manure and other agricul-

wood even though the pellets may contain a small amount

tural waste, if the product produces at least 200 watts of

of binding material used to form the pellets.

alternating current or at least 600 British thermal units per

• The sales price from the sale of fuel and electricity for use

day, but not including a product that is an uninterruptible

power source that is designed primarily for computers.

in farming are exempt all year.

8. Effective July 1, 2013, snowmaking and snow-grooming

A retailer of electricity, fuel, or natural gas shall have a signed

machines and equipment, including accessories, attach-

exemption certificate for exempt sales for residential or farm

ments, and parts for the machines and fuel and electricity

use unless any of the following apply:

used to operate such machines and equipment, that are

1. 100% of the electricity, fuel, or natural gas is for exempt

used exclusively and directly for snowmaking at ski hills,

use.

ski slopes, and ski trails.

2. The sale is to an account which is properly classified

9. Effective July 1, 2013, advertising and promotional direct

as residential or farm pursuant to schedules which are

mail and printing services used to produce advertising

filed for rate tariff with the Wisconsin Public Service

and promotional direct mail.

Commission which are in force at the time of sale.

3. The sale is to an account which is properly classified as

SIGNATURE: For corporations, this form must be signed by

residential or farm for classification purposes as directed

an employee or officer of the corporation.

by the Federal Rural Electrification Administration.

QUESTIONS: If you have questions, please contact us.

“Farm use” means used in farming, including use in a tractor

or other farm machines used directly in farming, in a furnace

WISCONSIN DEPARTMENT OF REVENUE

heating a farm building, in providing lighting in farm buildings,

Customer Service Bureau

and use in operating motors of machines used directly in

PO Box 8949

farming.

Madison WI 53708-8949

“Residential use” means use in a structure or portion of a

structure which is a person’s permanent principal residence.

Phone: (608) 266-2776

It does not include use in motor homes, travel trailers, other

Fax: (608) 267-1030

recreational vehicles, or transient accommodations. “Tran-

sient accommodations” means rooms or lodging available to

Website:

the public for a fee for a continuous period of less than one

month in a building such as a hotel, motel, inn, tourist home,

tourist house or court, summer camp, resort lodge, or cabin.

-4-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4