Form 1125-A - Cost Of Goods Sold

Download a blank fillable Form 1125-A - Cost Of Goods Sold in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 1125-A - Cost Of Goods Sold with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

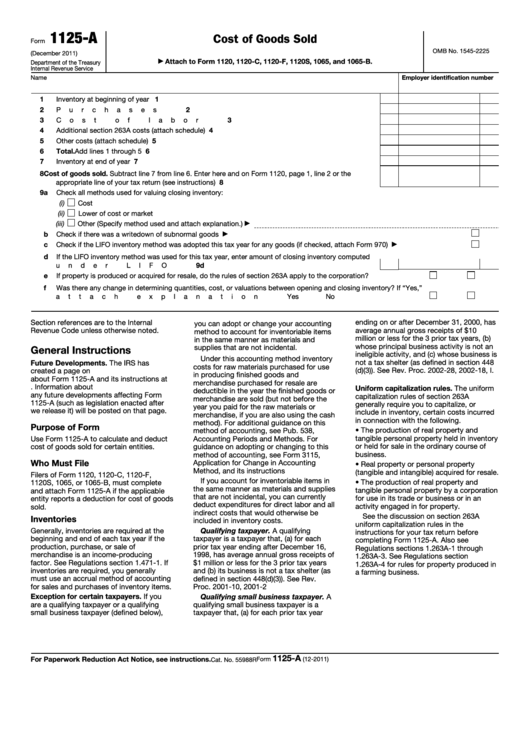

1125-A

Cost of Goods Sold

Form

OMB No. 1545-2225

(December 2011)

Attach to Form 1120, 1120-C, 1120-F, 1120S, 1065, and 1065-B.

Department of the Treasury

▶

Internal Revenue Service

Name

Employer identification number

1

Inventory at beginning of year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Purchases .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Cost of labor

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

4

Additional section 263A costs (attach schedule) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

5

Other costs (attach schedule)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Total. Add lines 1 through 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Inventory at end of year .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Cost of goods sold. Subtract line 7 from line 6. Enter here and on Form 1120, page 1, line 2 or the

appropriate line of your tax return (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9a

Check all methods used for valuing closing inventory:

(i)

Cost

(ii)

Lower of cost or market

(iii)

Other (Specify method used and attach explanation.)

▶

b

Check if there was a writedown of subnormal goods

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

c

Check if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970)

.

.

.

.

.

.

▶

d

If the LIFO inventory method was used for this tax year, enter amount of closing inventory computed

under LIFO .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9d

e

If property is produced or acquired for resale, do the rules of section 263A apply to the corporation?

.

.

.

.

.

Yes

No

f

Was there any change in determining quantities, cost, or valuations between opening and closing inventory? If “Yes,”

attach explanation

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

Section references are to the Internal

ending on or after December 31, 2000, has

you can adopt or change your accounting

Revenue Code unless otherwise noted.

average annual gross receipts of $10

method to account for inventoriable items

million or less for the 3 prior tax years, (b)

in the same manner as materials and

whose principal business activity is not an

supplies that are not incidental.

General Instructions

ineligible activity, and (c) whose business is

Under this accounting method inventory

not a tax shelter (as defined in section 448

Future Developments. The IRS has

costs for raw materials purchased for use

(d)(3)). See Rev. Proc. 2002-28, 2002-18, I.

created a page on IRS.gov for information

in producing finished goods and

R.B. 815.

about Form 1125-A and its instructions at

merchandise purchased for resale are

Information about

Uniform capitalization rules. The uniform

deductible in the year the finished goods or

any future developments affecting Form

capitalization rules of section 263A

merchandise are sold (but not before the

1125-A (such as legislation enacted after

generally require you to capitalize, or

year you paid for the raw materials or

we release it) will be posted on that page.

include in inventory, certain costs incurred

merchandise, if you are also using the cash

in connection with the following.

method). For additional guidance on this

Purpose of Form

• The production of real property and

method of accounting, see Pub. 538,

tangible personal property held in inventory

Use Form 1125-A to calculate and deduct

Accounting Periods and Methods. For

or held for sale in the ordinary course of

cost of goods sold for certain entities.

guidance on adopting or changing to this

business.

method of accounting, see Form 3115,

Who Must File

Application for Change in Accounting

• Real property or personal property

Method, and its instructions

(tangible and intangible) acquired for resale.

Filers of Form 1120, 1120-C, 1120-F,

If you account for inventoriable items in

• The production of real property and

1120S, 1065, or 1065-B, must complete

the same manner as materials and supplies

tangible personal property by a corporation

and attach Form 1125-A if the applicable

that are not incidental, you can currently

for use in its trade or business or in an

entity reports a deduction for cost of goods

deduct expenditures for direct labor and all

activity engaged in for property.

sold.

indirect costs that would otherwise be

See the discussion on section 263A

Inventories

included in inventory costs.

uniform capitalization rules in the

Generally, inventories are required at the

Qualifying taxpayer. A qualifying

instructions for your tax return before

beginning and end of each tax year if the

taxpayer is a taxpayer that, (a) for each

completing Form 1125-A. Also see

production, purchase, or sale of

prior tax year ending after December 16,

Regulations sections 1.263A-1 through

merchandise is an income-producing

1998, has average annual gross receipts of

1.263A-3. See Regulations section

factor. See Regulations section 1.471-1. If

$1 million or less for the 3 prior tax years

1.263A-4 for rules for property produced in

inventories are required, you generally

and (b) its business is not a tax shelter (as

a farming business.

must use an accrual method of accounting

defined in section 448(d)(3)). See Rev.

for sales and purchases of inventory items.

Proc. 2001-10, 2001-2 I.R.B. 272.

Exception for certain taxpayers. If you

Qualifying small business taxpayer. A

are a qualifying taxpayer or a qualifying

qualifying small business taxpayer is a

small business taxpayer (defined below),

taxpayer that, (a) for each prior tax year

1125-A

For Paperwork Reduction Act Notice, see instructions.

Form

(12-2011)

Cat. No. 55988R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3