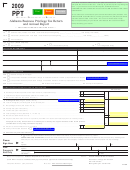

PROFESSIONAL PRIVILEGE TAX - PROFESSIONAL ATHLETES RETURN

General:

The professional privilege tax for professional athletes is $2,500 per game up to a maximum of three regular season games

played in Tennessee during the tax year. The tax is levied on players employed by the parent club for more than ten days during

the tax year and who are on the parent club’s active roster and eligible to participate in any game played in Tennessee during the tax

year, irrespective of whether the player actually participated in the game. Do not report any player for more than three games

during the tax year.

Players on minor league contracts or “two way” contracts are not subject to the tax unless they are on the parent club’s active

roster for more than ten days during the tax year.

Rosters must be maintained and provided with the return when filed that indicate which players were on the active roster and

for how many games. The amount of tax paid must agree with the number of game days (number of players times the number

of games for each player) reported on the tax return.

Filing Returns:

A return may be filed and tax payment made on an annual basis, reporting all players who played up to three games during the tax

year. However, organizations making payments for athletes may prefer to file returns and make payments following each individual

game played in Tennessee or at the end of each month in which a game was played in Tennessee. Each time a return is filed, the

“Filing Period” block must be completed to report the tax period beginning date and ending date.

For individual game returns, the filing period will be the day of the game. For example: “October 27, 2009.”

For monthly filed returns, the filing period will be the inclusive dates of that month. For example: “November 1 - 30, 2009.”

For annual returns, the filing period will be the statutory tax year. For example: “June 1, 2009 - May 31, 2010.”

A copy of the return must be filed with each payment made, reporting any players for whom tax is due since the last filed

return.

The tax year begins on June 1 each year and ends on May 31 of the following year. All tax returns for games played during a

specific tax year must be filed no later than June 1 following the end of each tax year in which tax is due.

INSTRUCTIONS FOR COMPLETION

Line 1:

Determine the number of players on the team’s active roster for only one game played in Tennessee during the tax filing period.

Multiply the number of players times 1 and enter the result.

Line 2:

Determine the number of players on the team’s active roster for only two games played in Tennessee during the tax filing

period. Multiply that number times 2 and enter the result.

Line 3:

Determine the number of players on the team’s active roster for three or more games played in Tennessee during the tax filing

period. Multiply that number times 3 and enter the result.

Line 4:

Determine the number of game days for which the professional privilege tax is due by adding the results in Lines 1, 2, and 3.

Enter the total number of game days.

Calculate the professional privilege tax amount due by multiplying Line 4 by $2,500. Enter the result here.

Line 5:

Enter any available credit amounts reported to you on Department of Revenue notices.

Line 6:

Line 7:

If the return is filed or payment is made after the due date reflected on the return, compute the amount of penalty due for the

number of days delinquent. Penalty is computed as follows: 1 - 30 days = 5%; 31 - 60 days = 10%; 61 - 90 days = 15%; 91 - 120

days = 20%; 121 days and over = 25%. The maximum penalty amount is 25%. The minimum penalty amount is $15, even if no

tax is due.

Line 8:

If the payment is made after the due date reflected on the return, compute the amount of interest due. Interest is computed

using the following formula: (Line 5 minus Line 6) x (current interest rate) x (number of days delinquent) / (365.25).

Line 9:

Calculate the total amount of remittance due with the return. Add Lines 5, 7, and 8; subtract Line 6.

Taxpayer’s or

A principal officer or other team representative must sign and date the return. If a tax preparer prepares the return for the

Tax Preparer’s

taxpayer, the preparer must also sign and date the return.

Signature:

Filing

Make payment payable to the Tennessee Department of Revenue for the amount shown on Line 9 of the return. Mail the return

Information:

with the payment and any attachments to: Tennessee Department of Revenue, Andrew Jackson State Office Building, 500

Deaderick Street, Nashville, Tennessee 37242. Payment of the tax by Electronic Funds Transfer (EFT) does not relieve you from

filing a timely return.

INTERNET (01-10)

RV-R0012701

1

1 2

2