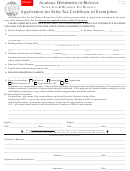

ST-62 (2/15) (back)

Instructions

those benefits, attach a list of these projects. For each

Filing requirements

project, include the project name and address, the legal

Every IDA must file this compliance report every year. The

name and EIN of the agent or project operator, and the

report must include:

reason why terms and conditions regarding recapture

• the terms and conditions for the recapture of state

were not included.

sales tax exemption benefits (as described in General

Municipal Law (GML) section 875(3)) within all of the

Activities and efforts to recapture state sales tax

exemption benefits

IDA’s resolutions and project documents. This applies

to:

The GML requires that each IDA recapture state sales

— projects established and agents or project operators

tax exemption benefits that were claimed by a project

appointed, and any financial assistance or

operator or agent, or other person or entity, whenever the

benefits were:

agreement for payments in lieu of taxes provided, on

or after March 28, 2013; and

• not entitled or authorized to be taken,

— any amendment or revision for additional funds

• in excess of the amounts authorized,

or benefits made on or after March 28, 2013, to

• for unauthorized property or services, or

projects established, agents or project operators

appointed, financial assistance provided, or

• for property or services not used according to the terms

payments in lieu of taxes provided, prior to

of the agreement with the IDA

March 28, 2013.

See Form ST-65, IDA Report of Recaptured Sales and

• information about efforts the IDA has made to recover,

Use Tax Benefits, for more information.

recapture, receive, or obtain (“recapture”) any state

IDAs must remit recaptured state sales tax benefit

sales tax exemption benefits and payments in lieu of

amounts to the Tax Department within 30 calendar days,

state sales taxes (“state sales tax exemption benefits”)

using Form ST-65.

from an agent/project operator, or other person or entity.

line 4: If the IDA made efforts to recapture sales tax

Every IDA must file Form ST-62 within 90 days of the end

exemption benefits during the fiscal year covered by

of each fiscal year.

this report and has not filed Form ST-65, attach an

The term state sales tax as used in this form includes both

explanation.

the state sales tax and the state use tax.

The attachment must include:

For more information, see TSB-M-14(1.1)S, Sales Tax

• name and address of the project and project number;

Reporting and Recordkeeping Requirements for Industrial

• legal name, EIN, and address of the agent/project

Development Agencies and Authorities.

operator or other person or entity;

Any IDA that fails to file or substantially complete this

• project beginning and end dates;

report may lose its authority to provide state sales tax

• the basis for recapture, as described above;

exemption benefits.

• date of recapture efforts;

Terms and conditions for the recapture of state

• amounts identified as required to be recaptured; and

sales tax exemption benefits

• amount recaptured, if different.

line 2A: If the IDA used the same standard terms and

conditions for the recapture of state sales tax exemption

When identifying recapture amounts, be sure to break

benefits in the project documents for all projects covered

down the total dollar amount into the categories below:

by this report, attach a copy of the terms and conditions

• state tax,

used. You are not required to attach the entire document.

• local tax,

Attach only the sections describing the state sales tax

recapture requirements described in GML section 875(3).

• MCTD tax (if applicable),

• penalties, and

line 2b: If the IDA used different terms and conditions

for the recapture of state sales tax exemption benefits

• interest.

in the project documents for the projects covered by this

If the amount recaptured was not paid in full, also include

report, attach a copy of the terms and conditions used

copies of correspondence exchanged between the IDA

and identify the project(s) to which they relate. Be sure to

and the agent/project operator or other entity or person

include the project name and address, and the legal name

regarding the recapture efforts.

and EIN of the agent or project operator for each project

identified.

Need help?

If the IDA provided state sales tax exemption benefits but

did not include terms and conditions for the recapture of

1

1 2

2