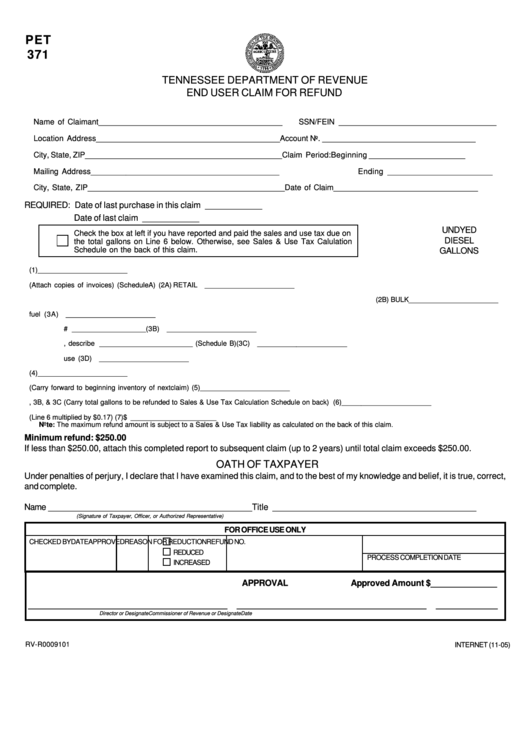

PET

371

TENNESSEE DEPARTMENT OF REVENUE

END USER CLAIM FOR REFUND

Name of Claimant __________________________________________

SSN/FEIN ____________________________________

Location Address __________________________________________

Account No. ___________________________________

City, State, ZIP _____________________________________________

Claim Period:

Beginning ______________________

Mailing Address ___________________________________________

Ending ________________________

City, State, ZIP _____________________________________________

Date of Claim _________________________________

REQUIRED: Date of last purchase in this claim ____________

Date of last claim ____________

UNDYED

Check the box at left if you have reported and paid the sales and use tax due on

DIESEL

the total gallons on Line 6 below. Otherwise, see Sales & Use Tax Calulation

Schedule on the back of this claim.

GALLONS

1. Beginning Inventory ........................................................................................................................................................... (1)

_______________________

2. Purchases (Attach copies of invoices) (Schedule A) ...................................................................................... (2A) RETAIL

_______________________

(2B) BULK

_______________________

3. Use - A. Heating fuel ................................................................................................................................................... (3A)

_______________________

B. Fabricating - Industrial Machinery # ___________________ .................................................................... (3B)

_______________________

C. Other non-highway, describe ________________________ (Schedule B) ............................................ (3C)

_______________________

D. Taxable use ................................................................................................................................................... (3D)

_______________________

4. Adjustments ....................................................................................................................................................................... (4)

_______________________

5. Ending Inventory (Carry forward to beginning inventory of next claim) .......................................................................... (5)

_______________________

6. Total of Line 3A, 3B, & 3C (Carry total gallons to be refunded to Sales & Use Tax Calculation Schedule on back) ...... (6)

_______________________

7. Maximum Diesel Tax Refund Amount (Line 6 multiplied by $0.17) .................................................................................... (7) $ ______________________

Note: The maximum refund amount is subject to a Sales & Use Tax liability as calculated on the back of this claim.

Minimum refund: $250.00

If less than $250.00, attach this completed report to subsequent claim (up to 2 years) until total claim exceeds $250.00.

OATH OF TAXPAYER

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct,

and complete.

Name ___________________________________________

Title ___________________________________________

(Signature of Taxpayer, Officer, or Authorized Representative)

FOR OFFICE USE ONLY

CHECKED BY

DATE

APPROVED

REASON FOR REDUCTION

REFUND NO.

REDUCED

PROCESS COMPLETION DATE

INCREASED

APPROVAL

Approved Amount $ ______________

__________________________________________

________________________________________

_____________

Director or Designate

Commissioner of Revenue or Designate

Date

RV-R0009101

INTERNET (11-05)

1

1 2

2 3

3 4

4