For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Jackson

Johnson City

Knoxville

Memphis

Nashville

Chattanooga

(423) 634-6266

(731) 423-5747

(423) 854-5321

(865) 594-6100

(901) 213-1400

(615) 253-0600

3rd Floor

Suite 350

Suite 340

204 High Point Drive

Room 606

3150 Appling Road

Bartlett, TN

Andrew Jackson Building

State Office Building

Lowell Thomas Building

State Office Building

500 Deaderick Street

540 McCallie Avenue

225 Martin Luther King Blvd.

531 Henley Street

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

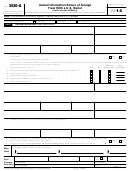

INSTRUCTIONS FOR COMPLETION OF ANNUAL TERMINAL OPERATOR RETURN

GENERAL INFORMATION

Complete all information at the top of the form including terminal name, address, terminal code, month and year of return, terminal

operator name, location address, account number, and FEIN. A separate terminal operator return must be completed for each terminal

in Tennessee. This return shall be filed for each calendar year on or before February 25 of the following year.

The return shall include data as follows:

(1) The amount of monthly gains or losses, in net gallons;

(2) The total net gallons removed from the terminal in bulk during the calendar year;

(3) The total net gallons removed across the terminal rack during the calendar year;

(4) The amount of tax due calculated pursuant to 67-3-302(b) and 67-3-303(c); and

(5) Such other information as the Department considers reasonably necessary to determine the tax liability of the terminal

operator under section 67-3-702.

Line 1

Total net gallons removed from terminal rack in bulk - Enter the total net gallons removed from the terminal in bulk during the

calendar year.

Line 2

Total net gallons removed from terminal across terminal rack - Enter the total net gallons removed across the terminal rack

during the calendar year.

Line 3

Total gallons removed from terminal - Add lines 1 & 2.

Line 4

Total losses or unaccounted for gallons of diesel which exceed the sum of any gains (net gallons) - Enter the total net gallons

of unaccounted for diesel which exceeds any gains.

Line 5

Multiply Line 3 by the provided rate.

Line 6

If Line 4 is greater than Line 5, then enter the difference; if Line 5 is greater than Line 4, then enter zero.

Line 7

Special Tax - Multiply Line 6 by the provided rate.

Line 8

Environmental Assurance Fee - Multiply Line 6 by the provided rate.

Line 9

Diesel Tax - Multiply Line 6 by the provided rate.

Line 10

Net tax due - Add lines 7, 8, and 9.

Line 14

Excess Loss Penalty - In the event the gallons lost or unaccounted for exceed five percent (5%) of the gallons removed from

that terminal across the rack, a penalty of one hundred percent (100%) of the taxes and fees otherwise due shall be paid by the

terminal operator with the taxes and fees due. - T.C.A. Section 67-3-505(b)

1

1 2

2