Small Business Bonus Scheme Application Form Page 2

ADVERTISEMENT

FALKIRK COUNCIL : SMALL BUSINESS BONUS SCHEME

1.

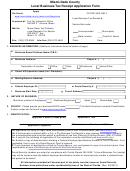

SMALL BUSINESS BONUS SCHEME

The rateable value thresholds and bandings of the Scheme have been increased to

reflect the 2010 Revaluation. The scheme permits rating authorities to abate at

varying prescribed levels, a ratepayer’s liability where the combined rateable value

of the properties owned/occupied throughout Scotland is £18,000 or less with effect

from 01/04/10. In addition, where the cumulative rateable value of a businesses

properties falls between £18,000 and £35,000, the Scheme will offer 25% relief to

individual properties with a rateable value £18,000 or under.

The exact level of relief therefore depends on:

(i) the total rateable value of all subjects owned or occupied by the ratepayer; and

(ii) whether or not the property is eligible for one of the existing non-discretionary rate

reliefs.

You may wish to visit the following websites for more information:

1. Scottish Government

2. Scottish Assessors Association

3. Falkirk Council

2.

LEVEL OF SMALL BUSINESS BONUS RELIEF

Combined rateable value

Percentage relief available

(RV) of all business

subject to eligibility

properties in Scotland

Up to £10,000

100%

£10,001 to £12,000

50%

£12,001 to £18,000

25%

Upper limit for cumulative

25%

(RV)* £35,000

*This will allow a business with 2 or more properties with a cumulative rateable value of under £35,000 to

qualify for relief at 25% on individual properties with a rateable value of £18,000 or less.

3.

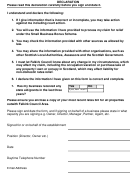

PROVISION OF INFORMATION BY APPLICANTS

If your business has received other public sector assistance in excess of £150,000

(200,000 euros) over a rolling three-year period (the de minimus limit for state

purposes) it is possible you may not qualify for relief under the scheme. This includes

small business rate relief, and local authority grants.

It is the responsibility of the applicant to ensure that the information provided in the

application made for Small Business Bonus Scheme is true and accurate and for this

purpose the applicant authorises the local authority to take such steps as necessary

to verify the claim.

4.

APPLICATIONS

A written application must be made by the Ratepayer in each local authority area in

which your business has a property. If there is a change of occupier a new

application is required for each local authority. Please ensure that you fully

complete both sides, sign, and date the application form.

PROVISION OF FALSE OR INACCURATE INFORMATION MAY LEAD TO

PROSECUTION BY THE AUTHORITY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4