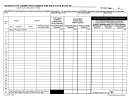

SCHEDULE OF TRANSACTIONS – INSTRUCTIONS

GENERAL INSTRUCTIONS

PRODUCT TYPES

(enter one fuel code per schedule)

Motor vehicle fuel suppliers, petroleum products carriers, and terminal

GASOLINE PRODUCT CODES AND FUEL TYPES

operators that file reports electronically with the department should use the

Reportable in Column 1 on your summary report (MF-002)

format indicated by this schedule for entering their transactions in detail.

065

Gasoline

123

Alcohol

“Restricted” suppliers and petroleum products shippers must use this

124

Gasohol 10%

schedule to detail gallons reportable on their Wisconsin fuel suppliers

241

Ethanol – Alcohol

monthly summary report (MF-002) and to compute the Wisconsin motor

E00-99

Ethanol 1% to 100%

vehicle fuel tax and petroleum inspection fee due.

M00-99

Methanol 1% to 100%

A separate schedule must be submitted for each fuel transaction that

UNDYED DIESEL FUEL PRODUCT CODES AND FUEL TYPES

does not have the same product code, mode code origin, position holder,

consignor, carrier, buyer/consignee, and destination.

Reportable in Column 2 on your summary report (MF-002)

161

Diesel Undyed #1

When completing this schedule, list each fuel transaction on a separate

167

Diesel Undyed #2

line. Enter the schedule total on the appropriate line and column of your

B00-99

Biodiesel Undyed 1% to 100%

Supplier Summary Report (MF-002).

OTHER PRODUCT CODES AND FUEL TYPES

If you are a petroleum products carrier only, use this schedule to detail

Reportable in Column 3 on your summary report (MF-002)

gallons reportable on your Petroleum Products Carrier Report (MF-008).

073

Kerosene Low Sulfur Dyed

074

Kerosene High Sulfur Dyed

SCHEDULE TYPES AND DEFINITIONS

122

Blending Components Other

Check the box of only one schedule type on the front of this form.

125

Aviation Gasoline

130

Jet Fuel

Sch. TD

Terminal Disbursements: Taxable disbursements from an IRS

145

Kerosene Low Sulfur Undyed

registered terminal and the destination state on the manifest is

147

Kerosene High Sulfur Undyed

Wisconsin.

226

Diesel High Sulfur Dyed

Terminal Disbursements: Nontaxable disbursements from

227

Diesel Low Sulfur #2 Dyed

a Wisconsin IRS registered terminal and the destination state

231

Diesel Low Sulfur #1 Dyed

on the manifest is outside Wisconsin.

D00-99

Biodiesel Dyed 1% to 100%

Sch. OD

Other disbursements or sales for import from locations other

The product codes are subject to change. You will be informed of any

than an IRS registered terminal and placed in a delivery truck

updates.

or transport whose destination on the manifest is Wisconsin.

Sch. 1F

Gallons on which Wisconsin tax and/or fees have been

TRANSPORTATION MODES

(enter one mode code per schedule)

paid and delivered to a Wisconsin IRS registered terminal or

alcohol-producing plant.

ORIGIN: Enter one of the following:

• Nine digit terminal code assigned by the Internal Revenue Service if the

Sch. 7

Exports: Tax-paid gasoline, undyed diesel fuel, or other

origin of the product is an IRS registered terminal.

products sold/delivered for export outside Wisconsin and the

• State abbreviation from which the product originated if not from an IRS

destination state on the manifest/invoice is a location outside

Wisconsin.

registered terminal.

Sch. 8

Sales to US Government: Tax-paid gasoline, undyed diesel

POSITION HOLDER: Not required on Schedule OD.

fuel, or other products sold/delivered to the US Government

CONSIGNOR: Not required on Schedule OD.

or its agencies tax-exempt.

CARRIER: Enter the FEIN or social security number of the carrier hauling

Sch. 10A Nonhighway Use: Tax-paid gasoline sold/delivered to exempt

the petroleum product.

customers in an amount not less than 100 gallons for off-road

use.

BUYER / CONSIGNEE: Not required on Schedule OD.

Sch. 10B General Aviation Fuel Use: Tax-paid gasoline sold/delivered

DESTINATION: Enter one of the following:

to licensed general aviation fuel dealers/users in an amount

• Nine digit terminal code assigned by the Internal Revenue Service if the

not less than 100 gallons for use in aircraft.

destination of the product is an IRS registered terminal.

• State abbreviation for which the product is destined if not for an IRS

Sch. 10C Urban Mass Transit: Tax-paid gasoline and undyed diesel

fuel sold/delivered to a common carrier for urban mass

registered terminal.

transportation in Wisconsin.

COLUMN INSTRUCTIONS

Sch. 10E Bad Debts: Tax-paid gasoline and undyed diesel fuel purchased

by customers and now uncollectible.

Column 1 Enter the bill of lading/manifest number from the document

issued at the terminal when product is removed over the rack. If the

Sch. 10G Trains: Tax-paid undyed diesel fuel sold/delivered to exempt

withdrawal is not from an IRS registered terminal, enter the invoice or

customers for use in trains.

ticket number.

Sch. 10H Heating Oil: Tax-paid undyed diesel fuel sold/delivered to

Column 2 Enter date the product was shipped (MM DD CCYY).

exempt customers for use as heating oil.

Column 3 Enter the net gallons disbursed (capacity gallons corrected to

Sch. 10T Native Americans: Tax-paid gasoline and undyed diesel

60°F temperature).

fuel sold/delivered to a Native American tribal council on

a reservation or trust lands in Wisconsin for use in their

Column 4 Enter the gross gallons disbursed (U.S. standard liquid

vehicles.

gallons – 231 cubic inches).

Sch. PD

Petroleum Deliveries: Carrier reporting of each delivery of

Column 5 Enter the number of gallons billed (should equal either net or

petroleum products made during the month via Wisconsin

gross gallons.

highways, pipelines, railroads and waterways.

Sch. TR

Terminal Receipts: Nontaxable receipts into an IRS registered

terminal.

1

1 2

2