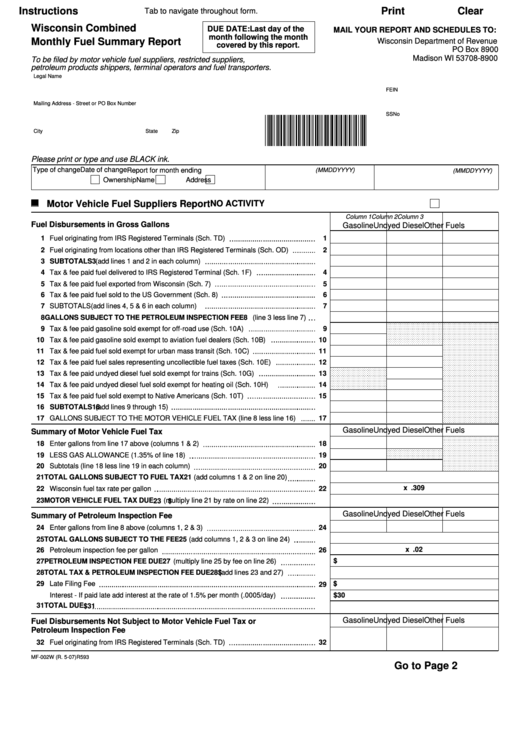

Instructions

Print

Clear

Tab to navigate throughout form.

Wisconsin Combined

DUE DATE: Last day of the

MAIL YOUR REPORT AND SCHEDULES TO:

month following the month

Monthly Fuel Summary Report

Wisconsin Department of Revenue

covered by this report.

PO Box 8900

Madison WI 53708-8900

To be filed by motor vehicle fuel suppliers, restricted suppliers,

petroleum products shippers, terminal operators and fuel transporters.

Legal Name

FEIN

Mailing Address - Street or PO Box Number

SSNo

*X10207991*

City

State

Zip

Please print or type and use BLACK ink.

Type of change

Date of change

(MMDDYYYY)

Report for month ending

(MMDDYYYY)

Ownership

Name

Address

Motor Vehicle Fuel Suppliers Report

NO ACTIVITY

Column 1

Column 2

Column 3

Fuel Disbursements in Gross Gallons

Gasoline

Undyed Diesel

Other Fuels

1

Fuel originating from IRS Registered Terminals (Sch. TD)

1

2

Fuel originating from locations other than IRS Registered Terminals (Sch. OD)

2

3 SUBTOTALS

(add lines 1 and 2 in each column)

3

4

Tax & fee paid fuel delivered to IRS Registered Terminal (Sch. 1F)

4

5

Tax & fee paid fuel exported from Wisconsin (Sch. 7)

5

6

Tax & fee paid fuel sold to the US Government (Sch. 8)

6

7

SUBTOTALS (add lines 4, 5 & 6 in each column)

7

8 GALLONS SUBJECT TO THE PETROLEUM INSPECTION FEE

(line 3 less line 7)

8

9

Tax & fee paid gasoline sold exempt for off-road use (Sch. 10A)

9

10

Tax & fee paid gasoline sold exempt to aviation fuel dealers (Sch. 10B)

10

11

Tax & fee paid fuel sold exempt for urban mass transit (Sch. 10C)

11

12

Tax & fee paid fuel sales representing uncollectible fuel taxes (Sch. 10E)

12

13

Tax & fee paid undyed diesel fuel sold exempt for trains (Sch. 10G)

13

14

Tax & fee paid undyed diesel fuel sold exempt for heating oil (Sch. 10H)

14

15

Tax & fee paid fuel sold exempt to Native Americans (Sch. 10T)

15

16 SUBTOTALS

(add lines 9 through 15)

16

17

GALLONS SUBJECT TO THE MOTOR VEHICLE FUEL TAX (line 8 less line 16)

17

Gasoline

Undyed Diesel

Other Fuels

Summary of Motor Vehicle Fuel Tax

18

Enter gallons from line 17 above (columns 1 & 2)

18

19

LESS GAS ALLOWANCE (1.35% of line 18)

19

20

Subtotals (line 18 less line 19 in each column)

20

21 TOTAL GALLONS SUBJECT TO FUEL TAX

(add columns 1 & 2 on line 20)

21

x .309

22

Wisconsin fuel tax rate per gallon

22

23 MOTOR VEHICLE FUEL TAX DUE

(multiply line 21 by rate on line 22)

23 $

Gasoline

Undyed Diesel

Other Fuels

Summary of Petroleum Inspection Fee

24

Enter gallons from line 8 above (columns 1, 2 & 3)

24

25 TOTAL GALLONS SUBJECT TO THE FEE

(add columns 1, 2 & 3 on line 24)

25

x .02

26

Petroleum inspection fee per gallon

26

$

27 PETROLEUM INSPECTION FEE DUE

(multiply line 25 by fee on line 26)

27

28 TOTAL TAX & PETROLEUM INSPECTION FEE DUE

(add lines 23 and 27)

28 $

29

Late Filing Fee

$

29

30

Interest - If paid late add interest at the rate of 1.5% per month (.0005/day)

30

$

31 TOTAL DUE

31

$

Gasoline

Undyed Diesel

Other Fuels

Fuel Disbursements Not Subject to Motor Vehicle Fuel Tax or

Petroleum Inspection Fee

32

Fuel originating from IRS Registered Terminals (Sch. TD)

32

MF-002W (R. 5-07)

R593

Go to Page 2

1

1 2

2 3

3 4

4