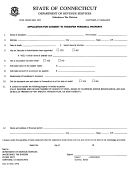

Form 3427, Page 2

Instructions for Completing Form 3427,

Application for Exemption of New Personal Property

As a supplement to the following instructions, please

Line 7: If there is someone in your business, other than

read State Tax Commission (STC) Bulletin No. 9 of

the person signing this application, who should be

1999 which explains the provisions of Public Act (P.A.)

contacted if further information is needed, please name

328 of 1998, as amended.

the person on line 7.

Line 1: P.A. 328 of 1998, as amended, states that, to

Line 10b: Note that a signature from a company official

qualify for exemption, New Personal Property must be

is required on line 13. This application cannot be

owned or leased by an Eligible Business. Please see

processed without a signature.

page 2 of STC Bulletin No. 9 of 1999 for the definition

of an Eligible Business. Please note that a copy of the

Lines 19 to 31: These lines must be completed by the

legal description for the property where the Eligible

Clerk of the Local Governmental Unit which has

Business is located must be attached.

adopted the resolution required by P.A. 328 of 1998, as

amended.

Line 2, 3, 4: Indicate the county; the city or township;

or village; and the local school district in which the New

Note that a copy of the resolution, a legal description,

Personal Property and the Eligible Business will be

and a detailed description of the business operations

located.

must be sent to the State Tax Commission along with

this application. Once issued, the exemption will pertain

Line 5: P.A. 328 of 1998, as amended, provides that an

to all new personal property placed in the eligible district

Eligible Business must be engaged in one of the

for the entire length of time approved by the local unit

following types of businesses: manufacturing, mining,

and issued by the State Tax Commission. The exemption

research and development, wholesale trade, or office

may not be limited to specific new personal property or

operations. Please see page 2 of STC Bulletin No. 9 of

a lesser time than the full length of issuance. If any of

1999 for the definition of an Eligible Business. Please

the information requested on lines 19 to 31 is missing,

note that a detailed description of the business operation

this form will be returned to the Clerk.

must be provided on a separate sheet.

Line 6 a-c: P.A. 328 of 1998, as amended, provides

that New Personal Property and the Eligible Business

must be located in an Eligible District. Please see page

4 of STC Bulletin No. 9 of 1998 for a listing of the

eight different types of Eligible Districts.

1

1 2

2