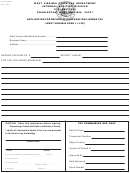

Form 13-9-A

Sales Tax Exemption for Blue Star Mothers of America

•

Section 5 of Senate Bill 806, effective November 1, 2007, provides a sales tax exemption for sales of tangible personal property for the Blue Star Mothers

of America.

•

The exemption only applies to certified purchases of tangible personal property actually sent to United States military personnel overseas who are serving

in a combat zone. The sales tax exemption does not apply to any sales tax levied by a city, town or county.

•

The exemption shall be administered in the form of a refund. The refund application for state sales taxes paid shall be filed within sixty (60) days after the

end of each calendar quarter.

•

Following are instructions for filing and a copy of the form to be used when making application for refund.

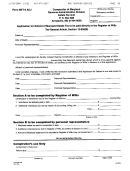

Instructions for Claimants

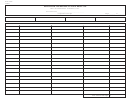

1. Claimant must complete all items on the reverse side. Please complete and attach supplemental pages if necessary.

2. Actual sales tax receipts must accompany claim.

3. Documentation must be submitted in a format suitable to determine the correct amount of refund.

When to File

1. The application for refund shall be filed with the Oklahoma Tax Commission on a calendar quarter.

2. The application for refund must be filed within three (3) years from the date the sales tax was paid by the claimant.

3. Failure to submit any of the substantiating documentation requested will result in the denial of the refund application.

Examples of Documentation

1. Actual sales tax receipts on which the tax was charged.

2. All receipts must be legible.

3. Purchases made outside the state of Oklahoma are not refundable.

4. Credit Card receipts must show the amount of sales tax paid.

1

1 2

2