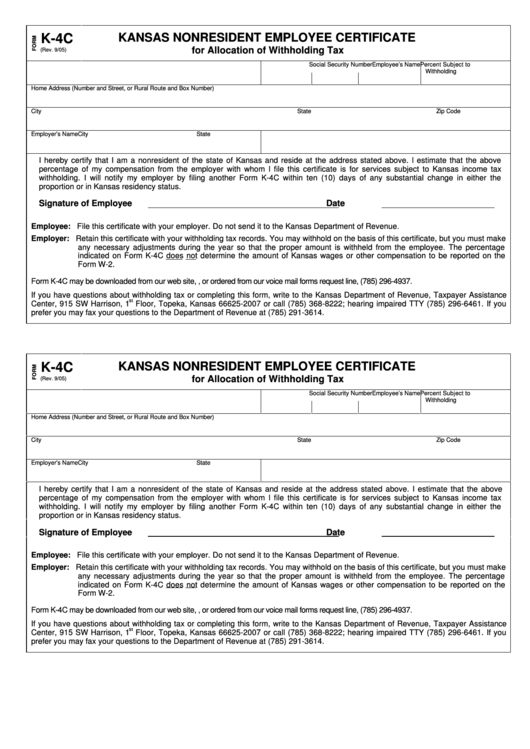

K-4C

KANSAS NONRESIDENT EMPLOYEE CERTIFICATE

for Allocation of Withholding Tax

(Rev. 9/05)

Employee’s Name

Social Security Number

Percent Subject to

Withholding

Home Address (Number and Street, or Rural Route and Box Number)

City

State

Zip Code

Employer’s Name

City

State

I hereby certify that I am a nonresident of the state of Kansas and reside at the address stated above. I estimate that the above

percentage of my compensation from the employer with whom I file this certificate is for services subject to Kansas income tax

withholding. I will notify my employer by filing another Form K-4C within ten (10) days of any substantial change in either the

proportion or in Kansas residency status.

Signature of Employee

Date

Employee: File this certificate with your employer. Do not send it to the Kansas Department of Revenue.

Employer: Retain this certificate with your withholding tax records. You may withhold on the basis of this certificate, but you must make

any necessary adjustments during the year so that the proper amount is withheld from the employee. The percentage

indicated on Form K-4C does not determine the amount of Kansas wages or other compensation to be reported on the

Form W-2.

Form K-4C may be downloaded from our web site, , or ordered from our voice mail forms request line, (785) 296-4937.

If you have questions about withholding tax or completing this form, write to the Kansas Department of Revenue, Taxpayer Assistance

st

Center, 915 SW Harrison, 1

Floor, Topeka, Kansas 66625-2007 or call (785) 368-8222; hearing impaired TTY (785) 296-6461. If you

prefer you may fax your questions to the Department of Revenue at (785) 291-3614.

K-4C

KANSAS NONRESIDENT EMPLOYEE CERTIFICATE

for Allocation of Withholding Tax

(Rev. 9/05)

Employee’s Name

Social Security Number

Percent Subject to

Withholding

Home Address (Number and Street, or Rural Route and Box Number)

City

State

Zip Code

Employer’s Name

City

State

I hereby certify that I am a nonresident of the state of Kansas and reside at the address stated above. I estimate that the above

percentage of my compensation from the employer with whom I file this certificate is for services subject to Kansas income tax

withholding. I will notify my employer by filing another Form K-4C within ten (10) days of any substantial change in either the

proportion or in Kansas residency status.

Signature of Employee

Date

Employee: File this certificate with your employer. Do not send it to the Kansas Department of Revenue.

Employer: Retain this certificate with your withholding tax records. You may withhold on the basis of this certificate, but you must make

any necessary adjustments during the year so that the proper amount is withheld from the employee. The percentage

indicated on Form K-4C does not determine the amount of Kansas wages or other compensation to be reported on the

Form W-2.

Form K-4C may be downloaded from our web site, , or ordered from our voice mail forms request line, (785) 296-4937.

If you have questions about withholding tax or completing this form, write to the Kansas Department of Revenue, Taxpayer Assistance

st

Center, 915 SW Harrison, 1

Floor, Topeka, Kansas 66625-2007 or call (785) 368-8222; hearing impaired TTY (785) 296-6461. If you

prefer you may fax your questions to the Department of Revenue at (785) 291-3614.

1

1