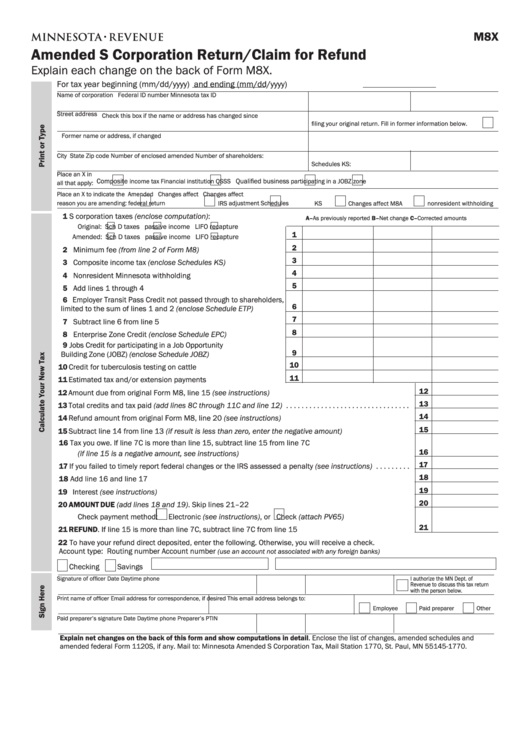

M8X

Amended S Corporation Return/Claim for Refund

Explain each change on the back of Form M8X .

For tax year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Name of corporation

Federal ID number

Minnesota tax ID

Street address

Check this box if the name or address has changed since

filing your original return. Fill in former information below.

Former name or address, if changed

City

State

Zip code

Number of enclosed amended

Number of shareholders:

Schedules KS:

Place an X in

Composite

Qualified business

income tax

Financial institution

QSSS

participating in a JOBZ zone

all that apply:

Place an X to indicate the

Amended

Changes affect

Changes affect

reason you are amending:

federal return

IRS adjustment

Schedules KS

Changes affect M8A

nonresident withholding

1 S corporation taxes (enclose computation):

A–As previously reported

B–Net change

C–Corrected amounts

Original:

Sch D taxes

passive income

LIFO recapture

1

. . . . .

Amended:

Sch D taxes

passive income

LIFO recapture

2

2 Minimum fee (from line 2 of Form M8) . . . . . . . . . . . . . . . . . . . . .

3

3 Composite income tax (enclose Schedules KS) . . . . . . . . . . . . . . .

4

4 Nonresident Minnesota withholding . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Employer Transit Pass Credit not passed through to shareholders,

6

limited to the sum of lines 1 and 2 (enclose Schedule ETP) . . . .

7

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Enterprise Zone Credit (enclose Schedule EPC) . . . . . . . . . . . . . .

9 Jobs Credit for participating in a Job Opportunity

9

Building Zone (JOBZ) (enclose Schedule JOBZ) . . . . . . . . . . . . . . . . .

10

10 Credit for tuberculosis testing on cattle . . . . . . . . . . . . . . . . . . . . .

11

11 Estimated tax and/or extension payments . . . . . . . . . . . . . . . . . .

12

12 Amount due from original Form M8, line 15 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13 Total credits and tax paid (add lines 8C through 11C and line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14 Refund amount from original Form M8, line 20 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15 Subtract line 14 from line 13 (if result is less than zero, enter the negative amount) . . . . . . . . . . . . . . . . .

16 Tax you owe . If line 7C is more than line 15, subtract line 15 from line 7C

16

(if line 15 is a negative amount, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17 If you failed to timely report federal changes or the IRS assessed a penalty (see instructions) . . . . . . . . .

18

18 Add line 16 and line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

20 AMOUNT DUE (add lines 18 and 19) . Skip lines 21–22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Check payment method:

Electronic (see instructions), or

Check (attach PV65)

21

21 REFUND . If line 15 is more than line 7C, subtract line 7C from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 To have your refund direct deposited, enter the following . Otherwise, you will receive a check .

Account type:

Routing number

Account number

(use an account not associated with any foreign banks)

Checking

Savings

Signature of officer

Date

Daytime phone

I authorize the MN Dept . of

Revenue to discuss this tax return

with the person below .

Print name of officer

Email address for correspondence, if desired

This email address belongs to:

Employee

Paid preparer

Other

Paid preparer’s signature

Date

Daytime phone

Preparer’s PTIN

Explain net changes on the back of this form and show computations in detail . Enclose the list of changes, amended schedules and

amended federal Form 1120S, if any . Mail to: Minnesota Amended S Corporation Tax, Mail Station 1770, St . Paul, MN 55145-1770 .

1

1 2

2 3

3 4

4