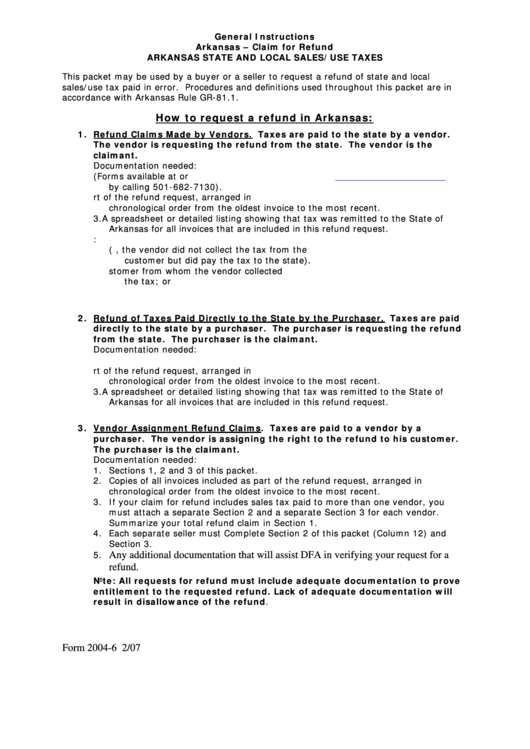

General Instructions

Arkansas – Claim for Refund

ARKANSAS STATE AND LOCAL SALES/USE TAXES

This packet may be used by a buyer or a seller to request a refund of state and local

sales/use tax paid in error. Procedures and definitions used throughout this packet are in

accordance with Arkansas Rule GR-81.1.

How to request a refund in Arkansas:

1. Refund Claims Made by Vendors. Taxes are paid to the state by a vendor.

The vendor is requesting the refund from the state. The vendor is the

claimant.

Documentation needed:

1. Section 1 and 2 of this packet. (Forms available at

or

by calling 501-682-7130).

2. Copies of all invoices included as part of the refund request, arranged in

chronological order from the oldest invoice to the most recent.

3. A spreadsheet or detailed listing showing that tax was remitted to the State of

Arkansas for all invoices that are included in this refund request.

4. Documentation to show that:

a. The vendor has borne the tax (i.e., the vendor did not collect the tax from the

customer but did pay the tax to the state).

b. The vendor repaid the tax to the customer from whom the vendor collected

the tax; or

c. The customer consents to refunding the tax to the vendor.

5. Any additional documentation that will assist DFA in verifying the refund claim.

2. Refund of Taxes Paid Directly to the State by the Purchaser. Taxes are paid

directly to the state by a purchaser. The purchaser is requesting the refund

from the state. The purchaser is the claimant.

Documentation needed:

1. Sections 1 and Section 2 of this packet

2. Copies of all invoices included as part of the refund request, arranged in

chronological order from the oldest invoice to the most recent.

3. A spreadsheet or detailed listing showing that tax was remitted to the State of

Arkansas for all invoices that are included in this refund request.

4. Any additional documentation that will assist DFA in verifying the refund claim.

3. Vendor Assignment Refund Claims. Taxes are paid to a vendor by a

purchaser. The vendor is assigning the right to the refund to his customer.

The purchaser is the claimant.

Documentation needed:

1. Sections 1, 2 and 3 of this packet.

2. Copies of all invoices included as part of the refund request, arranged in

chronological order from the oldest invoice to the most recent.

3. If your claim for refund includes sales tax paid to more than one vendor, you

must attach a separate Section 2 and a separate Section 3 for each vendor.

Summarize your total refund claim in Section 1.

4. Each separate seller must Complete Section 2 of this packet (Column 12) and

Section 3.

5.

Any additional documentation that will assist DFA in verifying your request for a

refund.

Note: All requests for refund must include adequate documentation to prove

entitlement to the requested refund. Lack of adequate documentation will

result in disallowance of the refund.

Form 2004-6 2/07

1

1 2

2 3

3 4

4 5

5