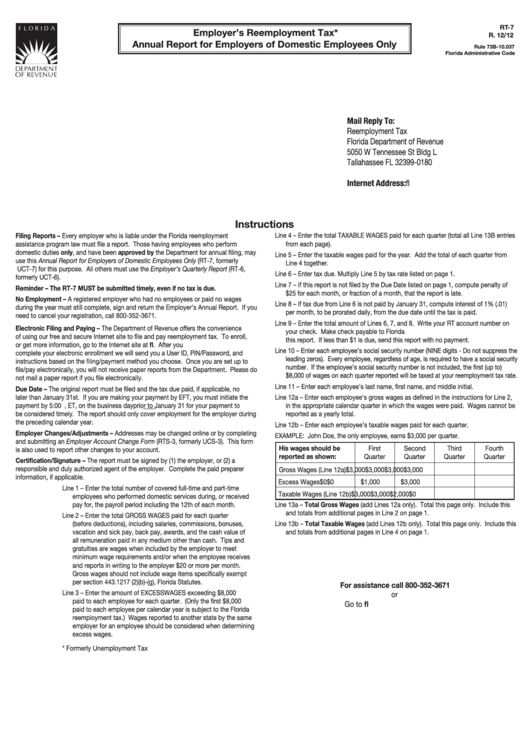

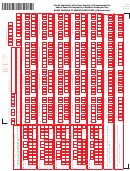

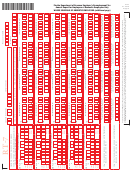

Form Rt-7 - Employer'S Reemployment Tax* Annual Report For Employers Of Domestic Employees Only

ADVERTISEMENT

RT-7

Employer’s Reemployment Tax*

R. 12/12

Annual Report for Employers of Domestic Employees Only

Rule 73B-10.037

Florida Administrative Code

Mail Reply To:

Reemployment Tax

Florida Department of Revenue

5050 W Tennessee St Bldg L

Tallahassee FL 32399-0180

Internet Address:

Instructions

Filing Reports – Every employer who is liable under the Florida reemployment

Line 4 – Enter the total TAXABLE WAGES paid for each quarter (total all Line 13B entries

assistance program law must file a report. Those having employees who perform

from each page).

domestic duties only, and have been approved by the Department for annual filing, may

Line 5 – Enter the taxable wages paid for the year. Add the total of each quarter from

use this Annual Report for Employers of Domestic Employees Only (RT-7, formerly

Line 4 together.

UCT-7) for this purpose. All others must use the Employer’s Quarterly Report (RT-6,

Line 6 – Enter tax due. Multiply Line 5 by tax rate listed on page 1.

formerly UCT-6).

Line 7 – If this report is not filed by the Due Date listed on page 1, compute penalty of

Reminder – The RT-7 MUST be submitted timely, even if no tax is due.

$25 for each month, or fraction of a month, that the report is late.

No Employment – A registered employer who had no employees or paid no wages

Line 8 – If tax due from Line 6 is not paid by January 31, compute interest of 1% (.01)

during the year must still complete, sign and return the Employer’s Annual Report. If you

per month, to be prorated daily, from the due date until the tax is paid.

need to cancel your registration, call 800-352-3671.

Line 9 – Enter the total amount of Lines 6, 7, and 8. Write your RT account number on

Electronic Filing and Paying – The Department of Revenue offers the convenience

your check. Make check payable to Florida U.C. Fund and enclose the check with

of using our free and secure Internet site to file and pay reemployment tax. To enroll,

this report. If less than $1 is due, send this report with no payment.

or get more information, go to the Internet site at . After you

Line 10 – Enter each employee’s social security number (NINE digits - Do not suppress the

complete your electronic enrollment we will send you a User ID, PIN/Password, and

leading zeros). Every employee, regardless of age, is required to have a social security

instructions based on the filing/payment method you choose. Once you are set up to

number. If the employee’s social security number is not included, the first (up to)

file/pay electronically, you will not receive paper reports from the Department. Please do

$8,000 of wages on each quarter reported will be taxed at your reemployment tax rate.

not mail a paper report if you file electronically.

Line 11 – Enter each employee’s last name, first name, and middle initial.

Due Date – The original report must be filed and the tax due paid, if applicable, no

later than January 31st. If you are making your payment by EFT, you must initiate the

Line 12a – Enter each employee’s gross wages as defined in the instructions for Line 2,

payment by 5:00 p.m., ET, on the business day prior to January 31 for your payment to

in the appropriate calendar quarter in which the wages were paid. Wages cannot be

be considered timely. The report should only cover employment for the employer during

reported as a yearly total.

the preceding calendar year.

Line 12b – Enter each employee’s taxable wages paid for each quarter.

Employer Changes/Adjustments – Addresses may be changed online or by completing

EXAMPLE: John Doe, the only employee, earns $3,000 per quarter.

and submitting an Employer Account Change Form (RTS-3, formerly UCS-3). This form

His wages should be

First

Second

Third

Fourth

is also used to report other changes to your account.

reported as shown:

Quarter

Quarter

Quarter

Quarter

Certification/Signature – The report must be signed by (1) the employer, or (2) a

responsible and duly authorized agent of the employer. Complete the paid preparer

Gross Wages (Line 12a)

$3,000

$3,000

$3,000

$3,000

information, if applicable.

Excess Wages

$0

$0

$1,000

$3,000

Line 1 – Enter the total number of covered full-time and part-time

Taxable Wages (Line 12b)

$3,000

$3,000

$2,000

$0

employees who performed domestic services during, or received

Line 13a – Total Gross Wages (add Lines 12a only). Total this page only. Include this

pay for, the payroll period including the 12th of each month.

and totals from additional pages in Line 2 on page 1.

Line 2 – Enter the total GROSS WAGES paid for each quarter

(before deductions), including salaries, commissions, bonuses,

Line 13b – Total Taxable Wages (add Lines 12b only). Total this page only. Include this

vacation and sick pay, back pay, awards, and the cash value of

and totals from additional pages in Line 4 on page 1.

all remuneration paid in any medium other than cash. Tips and

gratuities are wages when included by the employer to meet

minimum wage requirements and/or when the employee receives

and reports in writing to the employer $20 or more per month.

Gross wages should not include wage items specifically exempt

per section 443.1217 (2)(b)-(g), Florida Statutes.

For assistance call 800-352-3671

Line 3 – Enter the amount of EXCESS WAGES exceeding $8,000

or

paid to each employee for each quarter. (Only the first $8,000

Go to

paid to each employee per calendar year is subject to the Florida

reemployment tax.) Wages reported to another state by the same

employer for an employee should be considered when determining

excess wages.

* Formerly Unemployment Tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4