Form Rt-7 - Employer'S Reemployment Tax* Annual Report For Employers Of Domestic Employees Only Page 2

ADVERTISEMENT

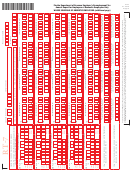

Use black ink. Example A - Handwritten Example B - Typed

Florida Department of Revenue Employer’s Reemployment Tax Annual Report for

RT-7

Example A

Example B

R. 12/12

0 1 2 3 4 5 6 7 8 9

Employers of Domestic Employees Only

0123456789

Page 1

Employers are required to file annual tax/wage reports regardless of employment activity or whether any taxes are due.

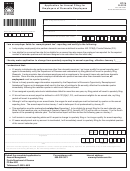

CALENDAR YEAR ENDING

DUE DATE

PENALTY AFTER DATE

TAX RATE

RT ACCOUNT NUMBER

/

/

Do not make any chang-

F.E.I. NUMBER

-

es to the pre-printed

information on this form.

If changes are needed,

request and complete

FOR OFFICIAL USE ONLY POSTMARK DATE

an Employer Account

/

/

Change Form (RTS-3).

1. Enter the total number of full-time and part-time covered employees who performed services during, or received pay for,

the payroll period including the 12th of the month.

Name

,

,

,

,

First Qtr. Ending 3/31

Second Qtr. Ending 6/30

Third Qtr. Ending 9/30

Fourth Qtr. Ending 12/31

Address

First

City/St/ZIP

Month

,

,

,

,

Second

Month

,

,

,

,

Third

Month

First Quarter Ending 3/31

Second Quarter Ending 6/30

Third Quarter Ending 9/30

Fourth Quarter Ending 12/31

,

.

,

.

,

.

,

.

Gross wages paid each quarter

2.

(enter total from all pages) ......................

,

.

,

.

,

.

,

.

Excess wages paid each quarter

3.

(See instructions) ....................................

,

.

,

.

,

.

,

.

Taxable wages for each quarter

4.

A A A

A A A

A A

B B B

B B B

B B

C C C

C C C

C C

D D D

D D D

D D

+

+

+

(enter total from all pages) ......................

,

.

,

.

Taxable wages for calendar year

Tax due

5.

6.

(see instructions, multiply

=

Tax Rate

X

RT-7

(see Line 4: A plus B plus C plus D = 5) .

Line 5 by tax rate) ....................................

,

.

+

Penalty due

7.

(see instructions) ........

,

.

+

Interest due

Make check payable to:

8.

(see instructions) ........

Florida U.C. Fund

,

.

Total amount due

9.

=

(Line 6 plus Line 7 plus Line 8) .............

Date

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (section 443.131(1) Florida Statutes).

Sign here

Title

Phone

(

)

Signature of employer

Preparer’s

Preparer check

Preparer’s SSN

signature

if self-employed

or PTIN

Paid

preparers

Date

FEIN

Firm’s name (or yours

only

if self-employed)

Preparer’s phone

and address

ZIP

(

)

number

DO NOT DETACH

Employer’s Reemployment Tax Annual Report for Employers of Domestic Employees Only Payment Coupon

RT-7

R. 12/12

Florida Department of Revenue

COMPLETE and MAIL with your REPORT/PAYMENT.

Please write your RT ACCOUNT NUMBER on check.

Be sure to SIGN YOUR CHECK.

DOR USE ONLY

Make check payable to: Florida U.C. Fund

POSTMARK OR HAND DELIVERY DATE

RT ACCOUNT NO.

-

F.E.I. NUMBER

US Dollars

Cents

,

AMOUNT ENCLOSED

Name

Address

PAYMENT FOR

City/St/ZIP

CALENDAR YEAR

RT-7

Check here if you transmitted

funds electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4