Form Ins-7 - Surplus Lines Premiums Tax Annual / Reconciliation Return - 2009

ADVERTISEMENT

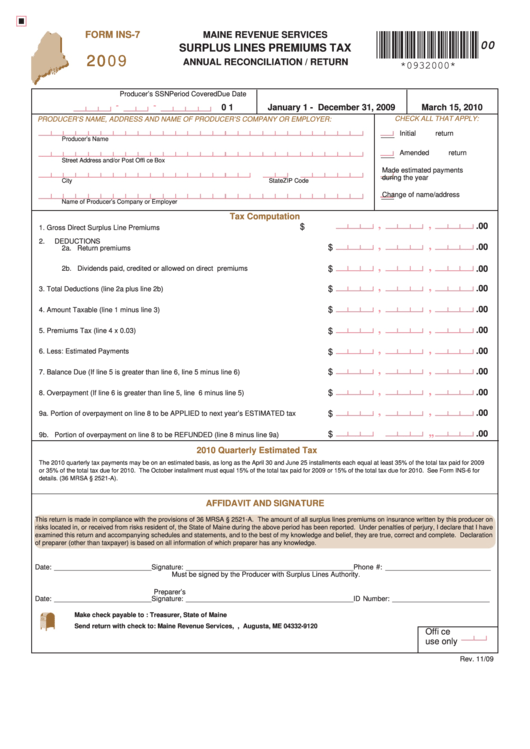

FORM INS-7

MAINE REVENUE SERVICES

00

SURPLUS LINES PREMIUMS TAX

2009

ANNUAL RECONCILIATION / RETURN

*0932000*

Producer’s SSN

Period Covered

Due Date

-

-

0 1

January 1 - December 31, 2009

March 15, 2010

CHECK ALL THAT APPLY:

PRODUCER’S NAME, ADDRESS AND NAME OF PRODUCER’S COMPANY OR EMPLOYER:

Initial return

Producer’s Name

Amended return

Street Address and/or Post Offi ce Box

Made estimated payments

during the year

City

State

ZIP Code

Change of name/address

Name of Producer’s Company or Employer

Tax Computation

,

,

.00

$

1.

Gross Direct Surplus Line Premiums ............................................................................ 1.

2.

DEDUCTIONS

,

,

.00

$

2a. Return premiums .............................................................................................. 2a.

,

,

2b. Dividends paid, credited or allowed on direct premiums ................................. 2b.

$

.00

,

,

.00

$

3.

Total Deductions (line 2a plus line 2b) ............................................................................ 3.

,

,

.00

$

4.

Amount Taxable (line 1 minus line 3) ............................................................................ 4.

,

,

.00

5.

Premiums Tax (line 4 x 0.03) ......................................................................................... 5.

$

,

,

.00

$

6.

Less: Estimated Payments ............................................................................................ 6.

,

,

.00

$

7.

Balance Due (If line 5 is greater than line 6, line 5 minus line 6) .................................. 7.

,

,

.00

$

8.

Overpayment (If line 6 is greater than line 5, line 6 minus line 5) ................................. 8.

,

,

.00

$

9a. Portion of overpayment on line 8 to be APPLIED to next year’s ESTIMATED tax ....... 9a.

,

,

.00

$

9b. Portion of overpayment on line 8 to be REFUNDED (line 8 minus line 9a) ................. 9b.

2010 Quarterly Estimated Tax

The 2010 quarterly tax payments may be on an estimated basis, as long as the April 30 and June 25 installments each equal at least 35% of the total tax paid for 2009

or 35% of the total tax due for 2010. The October installment must equal 15% of the total tax paid for 2009 or 15% of the total tax due for 2010. See Form INS-6 for

details. (36 MRSA § 2521-A).

AFFIDAVIT AND SIGNATURE

This return is made in compliance with the provisions of 36 MRSA § 2521-A. The amount of all surplus lines premiums on insurance written by this producer on

risks located in, or received from risks resident of, the State of Maine during the above period has been reported. Under penalties of perjury, I declare that I have

examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct and complete. Declaration

of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

#:

Date: _________________________ Signature: ___________________________________________ Phone

___________________________

Must be signed by the Producer with Surplus Lines Authority.

Preparer’s

Date: _________________________ Signature: ___________________________________________ ID Number: _________________________

Make check payable to :

Treasurer, State of Maine

Send return with check to:

Maine Revenue Services, P.O. Box 9120, Augusta, ME 04332-9120

Offi ce

use only

Rev. 11/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2