Clear Form

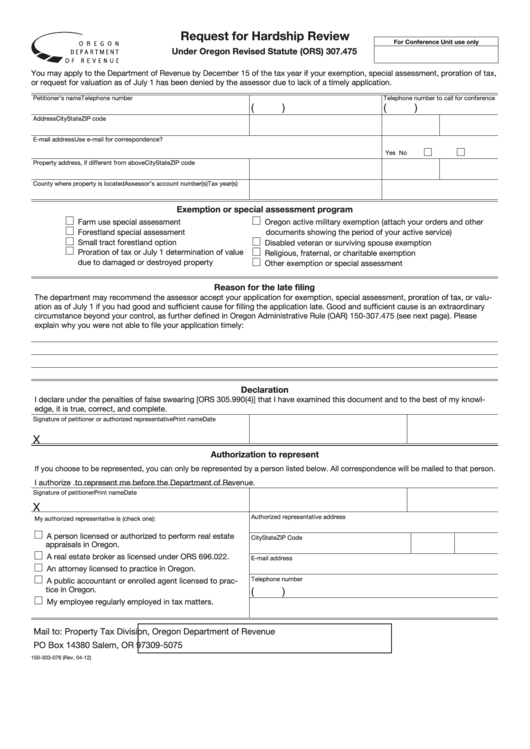

Request for Hardship Review

For Conference Unit use only

Under Oregon Revised Statute (ORS) 307.475

You may apply to the Department of Revenue by December 15 of the tax year if your exemption, special assessment, proration of tax,

or request for valuation as of July 1 has been denied by the assessor due to lack of a timely application.

Petitioner’s name

Telephone number

Telephone number to call for conference

(

)

(

)

Address

City

State

ZIP code

E-mail address

Use e-mail for correspondence?

Yes

No

Property address, if different from above

City

State

ZIP code

County where property is located

Assessor’s account number(s)

Tax year(s)

Exemption or special assessment program

Farm use special assessment

Oregon active military exemption (attach your orders and other

Forestland special assessment

documents showing the period of your active service)

Small tract forestland option

Disabled veteran or surviving spouse exemption

Proration of tax or July 1 determination of value

Religious, fraternal, or charitable exemption

due to damaged or destroyed property

Other exemption or special assessment

Reason for the late filing

The department may recommend the assessor accept your application for exemption, special assessment, proration of tax, or valu-

ation as of July 1 if you had good and sufficient cause for filling the application late. Good and sufficient cause is an extraordinary

circumstance beyond your control, as further defined in Oregon Administrative Rule (OAR) 150-307.475 (see next page). Please

explain why you were not able to file your application timely:

Declaration

I declare under the penalties of false swearing [ORS 305.990(4)] that I have examined this document and to the best of my knowl-

edge, it is true, correct, and complete.

Signature of petitioner or authorized representative

Print name

Date

X

Authorization to represent

If you choose to be represented, you can only be represented by a person listed below. All correspondence will be mailed to that person.

I authorize

to represent me before the Department of Revenue.

Signature of petitioner

Print name

Date

X

Authorized representative address

My authorized representative is (check one):

A person licensed or authorized to perform real estate

City

State

ZIP Code

appraisals in Oregon.

A real estate broker as licensed under ORS 696.022.

E-mail address

An attorney licensed to practice in Oregon.

Telephone number

A public accountant or enrolled agent licensed to prac-

tice in Oregon.

(

)

My employee regularly employed in tax matters.

Mail to: Property Tax Division, Oregon Department of Revenue

PO Box 14380 Salem, OR 97309-5075

150-303-076 (Rev. 04-12)

1

1 2

2