Form 150-303-066 - Petition For Waiver Of Late Filing Penalty

ADVERTISEMENT

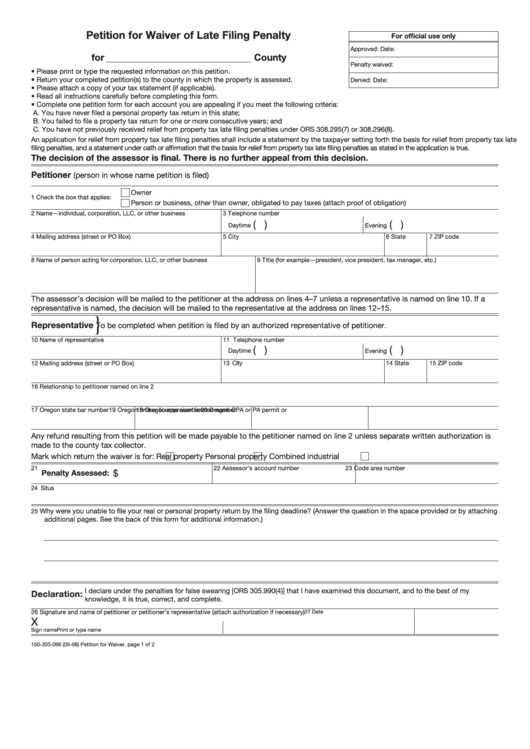

Petition for Waiver of Late Filing Penalty

For official use only

Approved:

Date:

for

County

Penalty waived:

• Please print or type the requested information on this petition.

• Return your completed petition(s) to the county in which the property is assessed.

Denied:

Date:

• Please attach a copy of your tax statement (if applicable).

• Read all instructions carefully before completing this form.

• Complete one petition form for each account you are appealing if you meet the following criteria:

A. You have never filed a personal property tax return in this state;

B. You failed to file a property tax return for one or more consecutive years; and

C. You have not previously received relief from property tax late filing penalties under ORS 308.295(7) or 308.296(8).

An application for relief from property tax late filing penalties shall include a statement by the taxpayer setting forth the basis for relief from property tax late

filing penalties, and a statement under oath or affirmation that the basis for relief from property tax late filing penalties as stated in the application is true.

The decision of the assessor is final. There is no further appeal from this decision.

Petitioner

(person in whose name petition is filed)

Owner

1 Check the box that applies:

Person or business, other than owner, obligated to pay taxes (attach proof of obligation)

2 Name—individual, corporation, LLC, or other business

3 Telephone number

(

)

(

)

Daytime

Evening

4 Mailing address (street or PO Box)

5 City

6 State

7 ZIP code

8 Name of person acting for corporation, LLC, or other business

9 Title (for example—president, vice president, tax manager, etc.)

The assessor’s decision will be mailed to the petitioner at the address on lines 4–7 unless a representative is named on line 10. If a

representative is named, the decision will be mailed to the representative at the address on lines 12–15.

}

Representative

To be completed when petition is filed by an authorized representative of petitioner.

10 Name of representative

11 Telephone number

(

)

(

)

Daytime

Evening

12 Mailing address (street or PO Box)

13 City

14 State

15 ZIP code

16 Relationship to petitioner named on line 2

17 Oregon state bar number

18 Oregon appraiser license number

19 Oregon broker license number

20 Oregon CPA or PA permit or S.E.A. number

Any refund resulting from this petition will be made payable to the petitioner named on line 2 unless separate written authorization is

made to the county tax collector.

Mark which return the waiver is for:

Real property

Personal property

Combined industrial

21

22 Assessor’s account number

23 Code area number

$

Penalty Assessed:

24 Situs

Why were you unable to file your real or personal property return by the filing deadline? (Answer the question in the space provided or by attaching

25

additional pages. See the back of this form for additional information.)

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document, and to the best of my

Declaration:

knowledge, it is true, correct, and complete.

26 Signature and name of petitioner or petitioner’s representative (attach authorization if necessary)

27 Date

X

Sign name

Print or type name

150-303-066 (05-08)

Petition for Waiver, page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2