Form Dr 0172 - Contractor Application For Exemption Certificate

ADVERTISEMENT

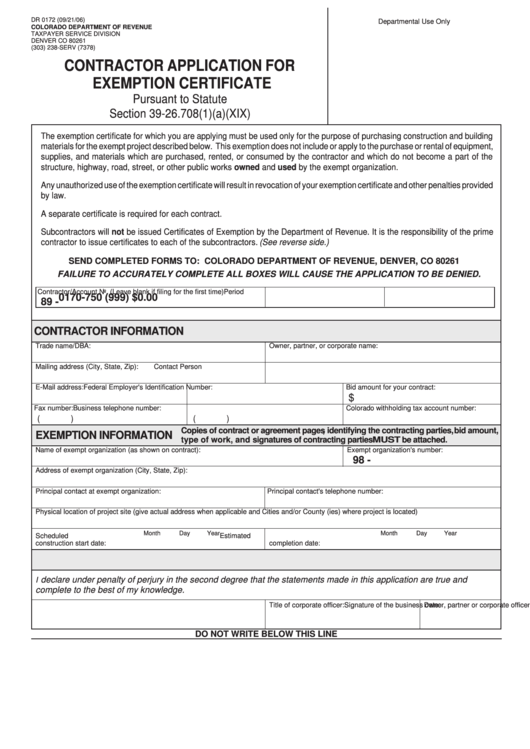

DR 0172 (09/21/06)

Departmental Use Only

COLORADO DEPARTMENT OF REVENUE

TAXPAYER SERVICE DIVISION

DENVER CO 80261

(303) 238-SERV (7378)

CONTRACTOR APPLICATION FOR

EXEMPTION CERTIFICATE

Pursuant to Statute

Section 39-26.708(1)(a)(XIX)

The exemption certificate for which you are applying must be used only for the purpose of purchasing construction and building

materials for the exempt project described below. This exemption does not include or apply to the purchase or rental of equipment,

supplies, and materials which are purchased, rented, or consumed by the contractor and which do not become a part of the

structure, highway, road, street, or other public works owned and used by the exempt organization.

Any unauthorized use of the exemption certificate will result in revocation of your exemption certificate and other penalties provided

by law.

A separate certificate is required for each contract.

Subcontractors will not be issued Certificates of Exemption by the Department of Revenue. It is the responsibility of the prime

contractor to issue certificates to each of the subcontractors. (See reverse side.)

SEND COMPLETED FORMS TO: COLORADO DEPARTMENT OF REVENUE, DENVER, CO 80261

FAILURE TO ACCURATELY COMPLETE ALL BOXES WILL CAUSE THE APPLICATION TO BE DENIED.

Contractor/Account No. (Leave blank if filing for the first time)

Period

0170-750 (999) $0.00

89 -

CONTRACTOR INFORMATION

Trade name/DBA:

Owner, partner, or corporate name:

Mailing address (City, State, Zip):

Contact Person

E-Mail address:

Federal Employer's Identification Number:

Bid amount for your contract:

$

Fax number:

Business telephone number:

Colorado withholding tax account number:

(

)

(

)

Copies of contract or agreement pages, identifying the contracting parties, bid amount,

EXEMPTION INFORMATION

type of work, and signatures of contracting parties MUST be attached.

Name of exempt organization (as shown on contract):

Exempt organization's number:

98 -

Address of exempt organization (City, State, Zip):

Principal contact at exempt organization:

Principal contact's telephone number:

Physical location of project site (give actual address when applicable and Cities and/or County (ies) where project is located)

Month

Day

Year

Month

Day

Year

Scheduled

Estimated

construction start date:

completion date:

declare under penalty of perjury in the second degree that the statements made in this application are true and

I

complete to the best of my knowledge.

Signature of the business owner, partner or corporate officer:

Title of corporate officer:

Date:

DO NOT WRITE BELOW THIS LINE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2