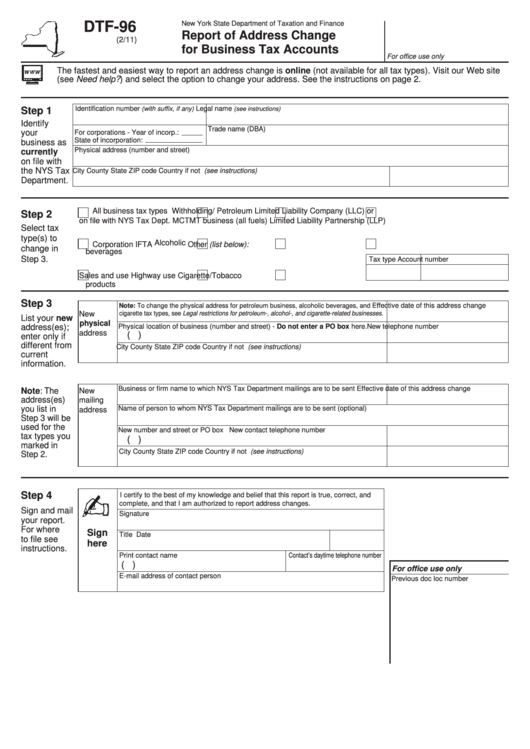

DTF-96

New York State Department of Taxation and Finance

Report of Address Change

(2/11)

for Business Tax Accounts

For office use only

The fastest and easiest way to report an address change is online (not available for all tax types). Visit our Web site

(see Need help?) and select the option to change your address. See the instructions on page 2.

Identification number

Legal name

(with suffix, if any)

Step 1

(see instructions)

Identify

Trade name (DBA)

your

For corporations - Year of incorp.:

State of incorporation:

business as

Physical address (number and street)

currently

on file with

the NYS Tax

City

County

State ZIP code

Country if not U.S. (see instructions)

Department.

All business tax types

Withholding/

Petroleum

Limited Liability Company (LLC) or

Step 2

on file with NYS Tax Dept.

MCTMT

business (all fuels)

Limited Liability Partnership (LLP)

Select tax

type(s) to

Alcoholic

Corporation

IFTA

Other (list below):

change in

beverages

Step 3.

Tax type

Account number

Sales and use

Highway use

Cigarette/Tobacco

products

Step 3

Note: To change the physical address for petroleum business, alcoholic beverages, and

Effective date of this address change

New

cigarette tax types, see Legal restrictions for petroleum-, alcohol-, and cigarette-related businesses.

List your new

physical

address(es);

Physical location of business (number and street) - Do not enter a PO box here.

New telephone number

address

(

)

enter only if

different from

City

County

State ZIP code

Country if not U.S. (see instructions)

current

information.

Business or firm name to which NYS Tax Department mailings are to be sent

Effective date of this address change

Note: The

New

address(es)

mailing

you list in

Name of person to whom NYS Tax Department mailings are to be sent (optional)

address

Step 3 will be

used for the

New number and street or PO box

New contact telephone number

tax types you

(

)

marked in

City

County

State ZIP code

Country if not U.S. (see instructions)

Step 2.

Step 4

I certify to the best of my knowledge and belief that this report is true, correct, and

complete, and that I am authorized to report address changes.

Sign and mail

Signature

your report.

For where

Sign

Title

Date

to file see

here

instructions.

Print contact name

Contact’s daytime telephone number

(

)

For office use only

E-mail address of contact person

Previous doc loc number

1

1 2

2