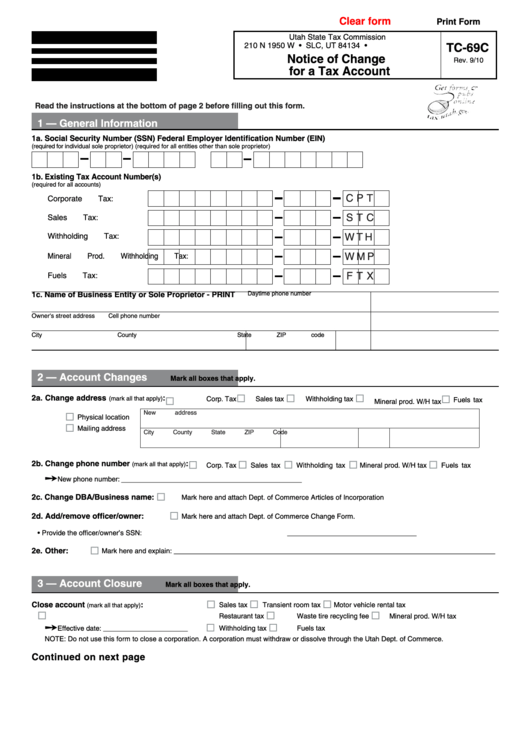

Clear form

Print Form

Utah State Tax Commission

210 N 1950 W • SLC, UT 84134 •

TC-69C

Notice of Change

Rev. 9/10

for a Tax Account

Read the instructions at the bottom of page 2 before filling out this form.

1 — General Information

1a. Social Security Number (SSN)

Federal Employer Identification Number (EIN)

(required for individual sole proprietor)

(required for all entities other than sole proprietor)

1b. Existing Tax Account Number(s)

(required for all accounts)

C P T

Corporate Tax:

S T C

Sales Tax:

Withholding Tax:

W T H

W M P

Mineral Prod. Withholding Tax:

F T X

Fuels Tax:

1c. Name of Business Entity or Sole Proprietor - PRINT

Daytime phone number

Owner's street address

Cell phone number

City

County

State

ZIP code

2 — Account Changes

Mark all boxes that apply.

2a. Change address

:

(mark all that apply)

Fuels tax

Corp. Tax

Sales tax

Withholding tax

Mineral prod. W/H tax

New address

Physical location

Mailing address

City

County

State

ZIP Code

2b. Change phone number

:

(mark all that apply)

Corp. Tax

Sales tax

Withholding tax

Mineral prod. W/H tax

Fuels tax

New phone number: _ _ _ _ _ _ _ __ _ _ _ _ __ __ _ _ __ _ _ _ _ _ _ _

2c. Change DBA/Business name:

Mark here and attach Dept. of Commerce Articles of Incorporation

2d. Add/remove officer/owner:

Mark here and attach Dept. of Commerce Change Form.

• Provide the officer/owner’s SSN: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2e. Other:

Mark here and explain: _ __ _ _ _ __ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __ _ __ __

3 — Account Closure

Mark all boxes that apply.

Close account

:

Sales tax

Transient room tax

Motor vehicle rental tax

(mark all that apply)

Restaurant tax

Waste tire recycling fee

Mineral prod. W/H tax

Effective date: _ _ _ _ _ _ _ _ _ _ __ _

Withholding tax

Fuels tax

NOTE: Do not use this form to close a corporation. A corporation must withdraw or dissolve through the Utah Dept. of Commerce.

Continued on next page

1

1 2

2