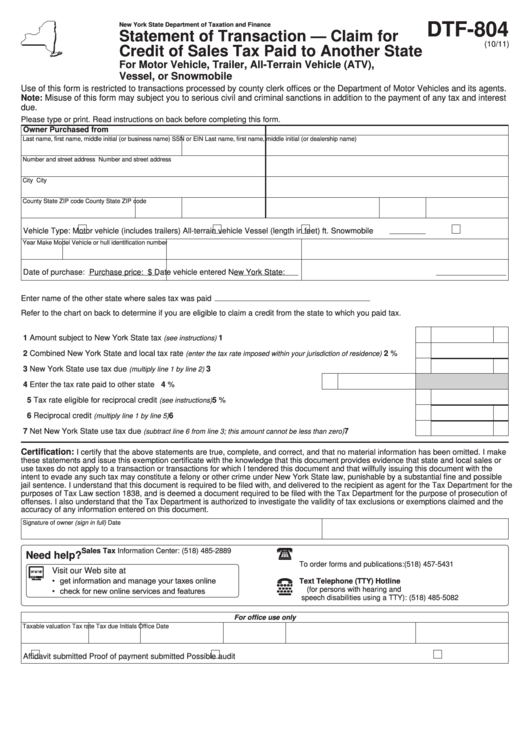

Form Dtf-804 - Statement Of Transaction - Claim For Credit Of Sales Tax Paid To Another State - New York State Department Of Taxation And Finance

ADVERTISEMENT

DTF‑804

New York State Department of Taxation and Finance

Statement of Transaction — Claim for

(10/11)

Credit of Sales Tax Paid to Another State

For Motor Vehicle, Trailer, All‑Terrain Vehicle (ATV),

Vessel, or Snowmobile

Use of this form is restricted to transactions processed by county clerk offices or the Department of Motor Vehicles and its agents.

Note: Misuse of this form may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest

due.

Please type or print. Read instructions on back before completing this form.

Owner

Purchased from

Last name, first name, middle initial (or business name)

SSN or EIN

Last name, first name, middle initial (or dealership name)

Number and street address

Number and street address

City

City

County

State

ZIP code

County

State

ZIP code

Vehicle Type:

Motor vehicle (includes trailers)

All-terrain vehicle

Vessel (length in feet)

ft.

Snowmobile

Year

Make

Model

Vehicle or hull identification number

Date of purchase:

Purchase price: $

Date vehicle entered New York State:

Enter name of the other state where sales tax was paid

Refer to the chart on back to determine if you are eligible to claim a credit from the state to which you paid tax.

1

Amount subject to New York State tax

.....................................................................................

1

(see instructions)

2

Combined New York State and local tax rate

..........

2

%

(enter the tax rate imposed within your jurisdiction of residence)

3

New York State use tax due

...........................................................................................

3

(multiply line 1 by line 2)

4

Enter the tax rate paid to other state .....................................................................

4

%

5

Tax rate eligible for reciprocal credit

.........................................................................................

5

%

(see instructions)

6

Reciprocal credit

.............................................................................................................

6

(multiply line 1 by line 5)

7

Net New York State use tax due

............................

7

(subtract line 6 from line 3; this amount cannot be less than zero)

Certification:

I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make

these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or

use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the

intent to evade any such tax may constitute a felony or other crime under New York State law, punishable by a substantial fine and possible

jail sentence. I understand that this document is required to be filed with, and delivered to the recipient as agent for the Tax Department for the

purposes of Tax Law section 1838, and is deemed a document required to be filed with the Tax Department for the purpose of prosecution of

offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the

accuracy of any information entered on this document.

Signature of owner (sign in full)

Date

Sales Tax Information Center:

(518) 485-2889

Need help?

To order forms and publications:

(518) 457-5431

Visit our Web site at

• get information and manage your taxes online

Text Telephone (TTY) Hotline

• check for new online services and features

(for persons with hearing and

speech disabilities using a TTY):

(518) 485-5082

For office use only

Taxable valuation

Tax rate

Tax due

Initials

Office

Date

Affidavit submitted

Proof of payment submitted

Possible audit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2