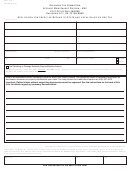

Form 13-9

Application for Credit or Refund of State and Local Sales or Use Tax Instructions

1. Instructions for claimants who do not hold Oklahoma permits.

A. Claimant must complete all items on reverse side.

B. Enter “casual” in space labeled “Permit Number (if registered vendor) or Account Number.”

C. Basis for the refund claim must be explained in detail and all documents necessary to substantiate it must be sub-

mitted. Photocopies are acceptable. Documents must be submitted in a format suitable to determine the correct

amount of refund or credit.

2. Instructions for claimants who hold Oklahoma permits.

A. All items on reverse side must be completed.

B. If a portion of the claim is to be applied as a credit on a sales tax return, and the balance is requested as a refund,

these amounts should be separately stated in the applicable box on the reverse side.

C. Basis for the refund claim must be explained in detail and all documents necessary to substantiate it must be sub-

mitted. Photocopies are acceptable. Documents must be submitted in a format suitable to determine the correct

amount of refund or credit.

D. If the basis of a claim for credit or refund is that a customer has given you a resale permit in lieu of sales tax after

you have remitted the tax with your return, you must submit the resale permit number and copies of the invoices

and credit memoranda involved in the claim. In the event the customer originally paid you the tax and subse-

quently submitted a resale permit to you requesting a credit or refund of his sales tax, proof of repayment to the

customer such as a copy of a cancelled check or credit memorandum should be submitted with your claim before

credit or refund may be allowed.

3. When to file.

The application for credit or refund must be filed within three (3) years from the date the tax was paid by the claim-

ant. Failure to submit any of the substantiating documentation requested will result in the denial of the credit or

refund application.

4. Examples of documentation.

A. Copies of the original invoices on which the tax was originally charged.

B. Copies of canceled checks used to remit the tax paid to the Tax Commission.

C. Activity recaps and tax report preparation worksheets.

D. Resale permits, manufacturer’s limited exemption numbers, and/or an explanation of exempt customers.

E. Copies of the credit memoranda or checks showing the tax collected and/or charged in error have been refunded

to your customers.

1

1 2

2