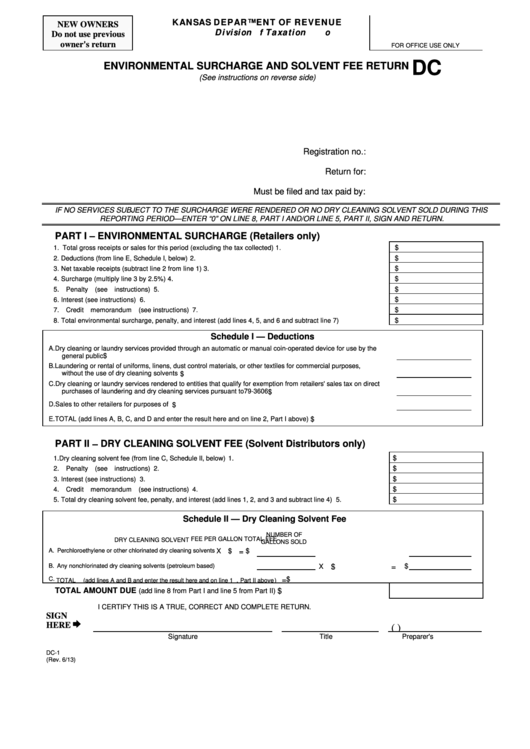

KANSAS DEPARTMENT OF REVENUE

NEW OWNERS

Division of Taxation

Do not use previous

owner's return

FOR OFFICE USE ONLY

DC

ENVIRONMENTAL SURCHARGE AND SOLVENT FEE RETURN

(See instructions on reverse side)

Registration no.:

Return for:

Must be filed and tax paid by:

IF NO SERVICES SUBJECT TO THE SURCHARGE WERE RENDERED OR NO DRY CLEANING SOLVENT SOLD DURING THIS

REPORTING PERIOD—ENTER “0” ON LINE 8, PART I AND/OR LINE 5, PART II, SIGN AND RETURN.

PART I – ENVIRONMENTAL SURCHARGE (Retailers only)

$

1. Total gross receipts or sales for this period (excluding the tax collected)......................................................

1.

$

2. Deductions (from line E, Schedule I, below) .................................................................................................

2.

$

3. Net taxable receipts (subtract line 2 from line 1)...........................................................................................

3.

$

4. Surcharge (multiply line 3 by 2.5%)..............................................................................................................

4.

$

5. Penalty (see instructions) ............................................................................................................................

5.

$

6. Interest (see instructions) ............................................................................................................................

6.

$

7. Credit memorandum (see instructions) ........................................................................................................

7.

$

8. Total environmental surcharge, penalty, and interest (add lines 4, 5, and 6 and subtract line 7) ...................

8.

Schedule I — Deductions

A. Dry cleaning or laundry services provided through an automatic or manual coin-operated device for use by the

$

general public .....................................................................................................................................................

B. Laundering or rental of uniforms, linens, dust control materials, or other textiles for commercial purposes,

without the use of dry cleaning solvents ..............................................................................................................

$

C. Dry cleaning or laundry services rendered to entities that qualify for exemption from retailers' sales tax on direct

purchases of laundering and dry cleaning services pursuant to K.S.A. 79-3606 ..................................................

$

D. Sales to other retailers for purposes of resale .....................................................................................................

$

E. TOTAL (add lines A, B, C, and D and enter the result here and on line 2, Part I above).......................................

$

PART II – DRY CLEANING SOLVENT FEE (Solvent Distributors only)

$

1. Dry cleaning solvent fee (from line C, Schedule II, below) ............................................................................

1.

$

2. Penalty (see instructions) ............................................................................................................................

2.

$

3. Interest (see instructions) ............................................................................................................................

3.

4. Credit memorandum (see instructions) ........................................................................................................

4.

$

$

5. Total dry cleaning solvent fee, penalty, and interest (add lines 1, 2, and 3 and subtract line 4) .....................

5.

Schedule II — Dry Cleaning Solvent Fee

NUMBER OF

FEE PER GALLON

TOTAL FEE

DRY CLEANING SOLVENT

GALLONS SOLD

A. Perchloroethylene or other chlorinated dry cleaning solvents

X $

$

=

B. Any nonchlorinated dry cleaning solvents (petroleum based)

X

$

=

$

C.

$

............................................... =

TOTAL (add lines A and B and enter the result here and on line 1, Part II above)

TOTAL AMOUNT DUE

.................................................

$

(add line 8 from Part I and line 5 from Part II)

I CERTIFY THIS IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGN

·

HERE

(

)

Signature

Title

Preparer's Phone No.

DC-1

(Rev. 6/13)

1

1 2

2