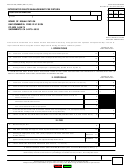

INSTRUCTIONS FOR COMPLETING THE

ENVIRONMENTAL SURCHARGE AND SOLVENT FEE RETURN DC-1

GENERAL INFORMATION

LINE 7 — Enter the amount of a verified credit memorandum

Pre-printed returns are mailed to registered dry cleaners,

issued by the Kansas Department of Revenue for an

laundry retailers, and dry cleaning solvent distributors. The

overpayment of surcharge fees. The credit memorandum(s)

return is due on or before the 25th day of the month following

must be enclosed with the return.

NOTE: A debit

the taxing period end (i.e., March and first quarter returns are

memorandum (balance due) must be paid by separate check

and returned to the Kansas Department of Revenue.

due by April 25th). The return must be filed even if no

services subject to the surcharge were rendered, or no dry

LINE 8—Add lines 4, 5, and 6 and subtract line 7. Enter the

cleaning solvent was sold during the reporting period.

result on line 8.

LINE-BY-LINE INSTRUCTIONS

PART II (Solvent Distributors Only)

PART I (Retailers Only)

LINE 1 — If you sold or distributed dry cleaning solvents during

the reporting period, complete "Schedule II—Dry Cleaning

LINE 1 — Enter the total sales of all dry cleaning or laundering

Solvent Fee" and enter the total on line 1. If no dry cleaning

services made during the reporting period (both taxable and

solvents were distributed during the reporting period, enter "0".

non-taxable). DO NOT include any sales tax or the

environmental surcharge collected in this figure.

LINE 2 — If you are filing a late return, multiply line 1 by the

applicable penalty. Information regarding the current or prior

LINE 2 — If line 1 includes any tax-exempt sales, complete

penalty

rates

can

be

obtained

from

our

web

site:

Schedule I—Deductions and enter total on line 2. If all sales

reported on line 1 were taxable, enter "0".

LINE 3 — If you are filing a late return, multiply line 1 by the

Exempt entities (Line C of Schedule I – Deductions):

applicable interest. Information regarding the current or prior

The following entities are exempt from paying the

interest

rates

can

be

obtained

from

our

web

site:

environmental surcharge on direct purchase of dry cleaning

or laundering services: The U.S. Government, its agencies

and instrumentalities; the state of Kansas and its political

LINE 4 — Enter the amount of a verified credit memorandum

subdivisions, (including school districts, counties, and

issued by the Kansas Department of Revenue for an

cities); elementary and secondary schools, non-commercial

overpayment of solvent fee(s).

The credit memorandum(s)

educational television and radio stations; nonprofit blood,

must be enclosed with the return.

NOTE: A debit

tissue, and organ banks; nonprofit educational institutions,

memorandum (balance due) must be paid by separate check

nonprofit 501(c)(3) historical societies and museums;

and returned to the Kansas Department of Revenue.

nonprofit hospitals; nonprofit 501(c)(3) primary care clinics

and

health

centers;

nonprofit

501(c)(3)

religious

LINE 5 — Add lines 1, 2, and 3 and subtract line 4. Enter the

organizations; and nonprofit 501(c)(3) zoos.

result on line 5.

LINE 3 — Subtract line 2 from line 1 and enter the result on

TOTAL AMOUNT DUE — Add line 8 from Part I and line 5

line 3. This is your net receipts subject to the environ-mental

from Part II and enter the result. This is the total amount due.

surcharge.

FINAL STEPS

LINE 4 — Multiply the amount on line 3 by 2.5% and enter the

result on line 4.

Make your check or money order payable to "Kansas

Environmental Surcharge" and write your tax registration

LINE 5 — If you are filing a late return, multiply line 4 by the

number and the period being paid on your remittance. Sign

applicable penalty. Penalty and interest is due if the return Is

the return and mail with your remittance. DO NOT staple your

not filed by the due date. Information regarding the current or

payment to the DC-1 return or send any other tax payment with

prior penalty/interest rates can be obtained from our web site:

this return.

Address all inquiries to Customer Relations / Miscellaneous

LINE 6 — If you are filing a late return, multiply line 4 by the

Tax, Kansas Department of Revenue, Topeka, Kansas,

applicable interest. Information regarding the current or prior

66612-1588,

call

785-368-8222

or

email

us

at

interest

rates

can

be

obtained

from

our

web

site:

miscellaneous.tax@kdor.ks.gov

1

1 2

2