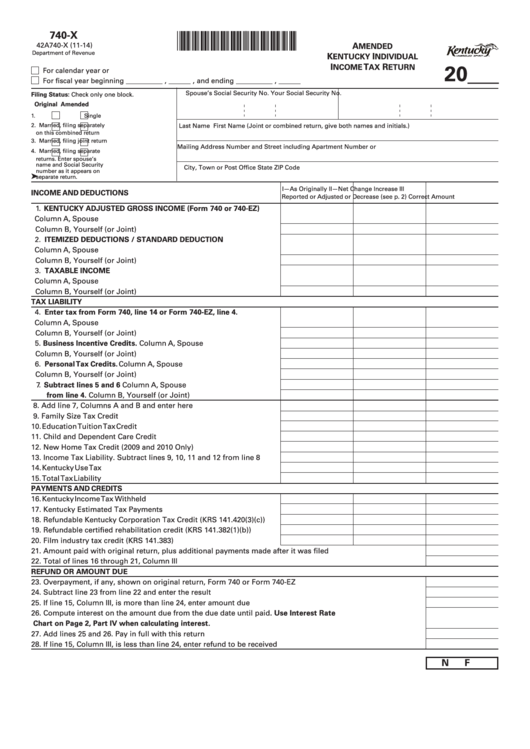

740-X

*1400030008*

42A740-X (11-14)

A

MENDED

Department of Revenue

K

I

ENTUCKY

NDIVIDUAL

I

T

R

20___

NCOME

AX

ETURN

For calendar year or

__________ , ______ ,

__________ , ______

For fiscal year beginning

and ending

Spouse’s Social Security No.

Your Social Security No.

Filing Status: Check only one block.

Original Amended

1.

Single

Last Name

First Name (Joint or combined return, give both names and initials.)

2.

Married, filing separately

on this combined return

3.

Married, filing joint return

Mailing Address

Number and Street including Apartment Number or P .O. Box

4.

Married, filing separate

returns. Enter spouse’s

name and Social Security

City, Town or Post Office

State

ZIP Code

number as it appears on

➤

separate return.

I—As Originally

II—Net Change Increase

III

INCOME AND DEDUCTIONS

Reported or Adjusted

or Decrease (see p. 2)

Correct Amount

1. KENTUCKY ADJUSTED GROSS INCOME (Form 740 or 740-EZ)

Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

2. ITEMIZED DEDUCTIONS / STANDARD DEDUCTION

Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

3. TAXABLE INCOME

Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

TAX LIABILITY

4. Enter tax from Form 740, line 14 or Form 740-EZ, line 4.

Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

5. Business Incentive Credits. Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

6. Personal Tax Credits.

Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

7. Subtract lines 5 and 6

Column A, Spouse ..............................

Column B, Yourself (or Joint) .............

from line 4.

8. Add line 7, Columns A and B and enter here .....................................

9. Family Size Tax Credit ..........................................................................

10. Education Tuition Tax Credit .................................................................

11. Child and Dependent Care Credit .......................................................

12. New Home Tax Credit (2009 and 2010 Only) ......................................

13. Income Tax Liability. Subtract lines 9, 10, 11 and 12 from line 8 .......

14. Kentucky Use Tax ..................................................................................

15. Total Tax Liability ..................................................................................

PAYMENTS AND CREDITS

16. Kentucky Income Tax Withheld ............................................................

17. Kentucky Estimated Tax Payments ......................................................

18. Refundable Kentucky Corporation Tax Credit (KRS 141.420(3)(c)) ....

19. Refundable certified rehabilitation credit (KRS 141.382(1)(b)) ..........

20. Film industry tax credit (KRS 141.383) ................................................

21. Amount paid with original return, plus additional payments made after it was filed ..........................................

22. Total of lines 16 through 21, Column III ....................................................................................................................

REFUND OR AMOUNT DUE

23. Overpayment, if any, shown on original return, Form 740 or Form 740-EZ ...........................................................

24. Subtract line 23 from line 22 and enter the result ....................................................................................................

25. If line 15, Column III, is more than line 24, enter amount due ................................................................................

26. Compute interest on the amount due from the due date until paid. Use Interest Rate

Chart on Page 2, Part IV when calculating interest..................................................................................................

27. Add lines 25 and 26. Pay in full with this return .......................................................................................................

28. If line 15, Column III, is less than line 24, enter refund to be received ...................................................................

N

F

1

1 2

2