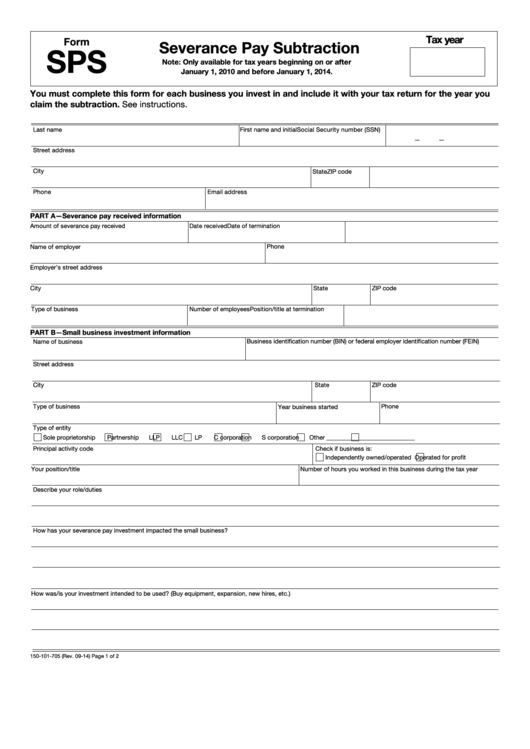

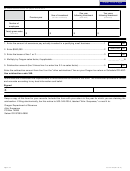

Clear This Page

Tax year

Form

Severance Pay Subtraction

SPS

Note: Only available for tax years beginning on or after

January 1, 2010 and before January 1, 2014.

You must complete this form for each business you invest in and include it with your tax return for the year you

claim the subtraction. See instructions.

Last name

First name and initial

Social Security number (SSN)

—

—

Street address

City

State

ZIP code

Phone

Email address

PART A—Severance pay received information

Amount of severance pay received

Date received

Date of termination

Name of employer

Phone

Employer’s street address

City

State

ZIP code

Type of business

Number of employees

Position/title at termination

PART B—Small business investment information

Business identification number (BIN) or federal employer identification number (FEIN)

Name of business

Street address

City

State

ZIP code

Type of business

Phone

Year business started

Type of entity

Sole proprietorship

Partnership

LLP

LLC

LP

C corporation

S corporation

Other _____________________________

Principal activity code

Check if business is:

Independently owned/operated

Operated for profit

Your position/title

Number of hours you worked in this business during the tax year

Describe your role/duties

How has your severance pay investment impacted the small business?

How was/is your investment intended to be used? (Buy equipment, expansion, new hires, etc.)

150-101-705 (Rev. 09-14)

Page 1 of 2

1

1 2

2 3

3