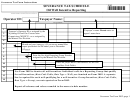

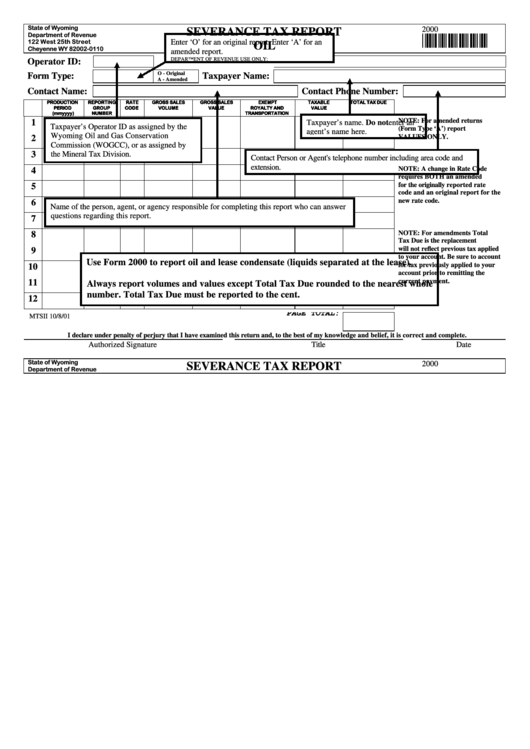

Form 2000 - Severance Tax Report Oil

ADVERTISEMENT

State of Wyoming

2000

SEVERANCE TAX REPORT

Department of Revenue

*2000*

122 West 25th Street

Enter ‘O’ for an original report. Enter ‘A’ for an

OIL

Cheyenne WY 82002-0110

amended report.

DEPARTMENT OF REVENUE USE ONLY:

Operator ID:

O - Original

Form Type:

Taxpayer Name:

A - Amended

Contact Name:

Contact Phone Number:

PRODUCTION

REPORTING

RATE

GROSS SALES

GROSS SALES

EXEMPT

TAXABLE

TOTAL TAX DUE

PERIOD

GROUP

CODE

VOLUME

VALUE

ROYALTY AND

VALUE

(mmyyyy)

NUMBER

TRANSPORTATION

NOTE: For amended returns

1

Taxpayer’s name. Do not enter an

Taxpayer’s Operator ID as assigned by the

(Form Type ‘A’) report

agent’s name here.

Wyoming Oil and Gas Conservation

VALUES ONLY.

2

Commission (WOGCC), or as assigned by

3

the Mineral Tax Division.

Contact Person or Agent's telephone number including area code and

extension.

NOTE: A change in Rate Code

4

requires BOTH an amended

for the originally reported rate

5

code and an original report for the

new rate code.

6

Name of the person, agent, or agency responsible for completing this report who can answer

questions regarding this report.

7

NOTE: For amendments Total

8

Tax Due is the replacement

will not reflect previous tax applied

9

to your account. Be sure to account

Use Form 2000 to report oil and lease condensate (liquids separated at the lease).

for tax previously applied to your

10

account prior to remitting the

current payment.

11

Always report volumes and values except Total Tax Due rounded to the nearest whole

number. Total Tax Due must be reported to the cent.

12

MTSII 10/8/01

PAGE TOTAL:

I declare under penalty of perjury that I have examined this return and, to the best of my knowledge and belief, it is correct and complete.

Authorized Signature

Title

Date

State of Wyoming

2000

SEVERANCE TAX REPORT

Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6