Form Sc1065 - Schedule Sc-K - Partnership Return Tax Year 2013 Page 2

ADVERTISEMENT

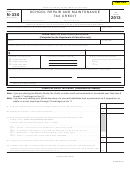

Form SC1065

SCHEDULE SC-K

PARTNERS' SHARES OF INCOME (LOSSES), DEDUCTIONS, CREDITS ETC. (See instructions.)

* Enter amounts from corresponding lines on your federal Schedule K in Column A.

(A)*

(B)

(C)

(D)

(E)

(F)

Plus or Minus

Federal Schedule K

Amounts

Amounts Allocated

Amounts Subject

Enter Amounts From

South Carolina

Amounts After

Allocated to SC

to States Other

to Apportionment

Federal Schedule K

Adjustment

SC Adjustments

Than SC

Ordinary Business Income (loss)

1

Net Real Estate Rents (loss)

2

Other Net Rents (loss)

3

Guaranteed Payments

4

Interest Income

5

Dividends

6

Royalties

7

Net Short Term Cap. Gain (loss)

8

Net Long Term Cap. Gain (loss)

9

Net § 1231 gain (loss)

10

Other Income (loss)

11

§ 179 Deduction

12

Contributions

13a

Investment Interest Expense

13b

§ 59 (e)(2) Expenditures

13c

Other Deductions

13d

Total

14

15. Amounts from federal Schedule K (line 14, Schedule SC-K, Col. A) . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16

16. Amount Allocated to South Carolina (from line 14, Schedule SC-K, Col. D) . . . . . . . . . . . . . . . . . . . . .

17. Net income (loss) subject to apportionment (from line 14, Schedule SC-K, Col. F) . . . . . . . . . . . . . . . .

17

APPORTIONMENT

TOTAL

SC

18. Total Sales or Gross Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . .

÷

19

19. Apportionment factor (SC

TOTAL). 100% if operating entirely within SC . . . . . . . . . . . . . . . . . . . . .

%

20

20. Net business income (loss) apportioned to SC (line 17 multiplied by line 19) . . . . . . . . . . . . . . . . . . . .

21

21. Net business income (loss) taxable to SC (line 16 plus line 20). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30872022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7