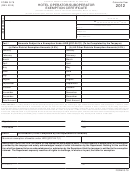

FORM G-79

PAGE 2

(REV. 2012)

General Instructions

(Note: Photocopied or facsimile transmissions of Form G-79 will

not be accepted.)

Purpose of Form

Specific Instructions

Act 91, Session Laws of Hawaii (SLH) 2010 provides that the gen-

Step 1 - Enter the taxpayer’s name, the last four digits of the

eral excise tax (GET) exemption under Hawaii Revised Statutes

taxpayer’s federal identification number (FEIN) or social security

(HRS) §237-24.7(1) for certain taxpayers is limited to $400,000

number (SSN), whichever is applicable, and mailing address in the

in tax per calendar year in aggregate for all taxpayers. In order to

designated spaces of the form.

claim this exemption, taxpayers must:

Step 2 - Enter the name of a contact person, his/her daytime

(1) Obtain certification from the Department of Taxation (Depart-

tele phone number, and e-mail address in the spaces provided in

ment) by submitting a properly completed application on

contact information area of the form.

Form G-79 to the Department on or before March 15, 2013

(Note: Failure to file Form G-79 on or before March 15, 2013

Part I

will result in the disallowance of the exemption);

Column (a) - For amounts sourced to Oahu, enter by month, the

(2) Report the exemption on Form G-49 and Schedule GE

total amount of

employee wages, salaries, payroll taxes, insurance

(Note: The amount of the exemption claimed cannot exceed

premiums and benefits (including retirement, vacation, sick pay,

the amount certified by the Department); and

and health benefits)

eligible to be taken as a general excise tax

(3) File Form G-49 with Schedule GE and the Department certi-

exemption

under HRS §237-24.7(1) and subject to the cap under

fied Form G-79 with the Department.

Act 91, SLH 2010.

For more information, please see Tax Information Release No.

Column (b) - For amounts sourced to all other districts except

2010-08.

Oahu, enter by month, the total amount of

employee wages, sala-

ries, payroll taxes, insurance premiums and benefits (including

Who Must File

retirement, vacation, sick pay, and health benefits)

eligible to be

taken as a general excise tax exemption

under HRS §237-24.7(1)

Obtaining certification from the Department is a prerequisite for

and subject to the cap under Act 91, SLH 2010.

claiming a general excise tax exemption under HRS §237-24.7(1)

for the following taxpayers:

Total Amount - Add the amounts reported in column (a) and report

the total in column (a) on the “Total Amount” line. Add the amounts

z A hotel operator claiming a general excise tax exemption un-

reported in column (b) and report the total in column (b) on the

der section 237-24.7(1) for amounts received from a timeshare

“Total Amount” line.

association and disbursed by the hotel operator for employee

wages, salaries, payroll taxes, insurance premiums and benefits

Signature of Taxpayer

(including retirement, vacation, sick pay, and health benefits);

or

Individuals - To obtain certification, you or your duly authorized

agent must sign, date, and print the signatory’s name and title in

z A hotel suboperator claiming a general excise tax exemption un-

the spaces provided on the form.

der section 237-24.7(1) for amounts received from the owner of

the hotel, from a timeshare association, or from the operator of

Corporations, S-Corporations, Partnerships, and Limited Li-

the hotel, and disbursed by the hotel suboperator for employee

ability Companies - To obtain certification, the president, vice

wages, salaries, payroll taxes, insurance premiums and benefits

president, treasurer, secretary, or any other corporate officer (such

(including retirement, vacation, sick pay, and health benefits).

as a tax officer), partner, or member who is authorized to sign on

the taxpayer’s behalf must sign and date, and print his/her name

When to File

and title in the spaces provided on the form.

Obtaining Certification. Taxpayers (including both calendar year

and fiscal year taxpayers) who are eligible to claim this exemp-

Part II

tion must submit a properly completed and signed Form G-79 to

Part II will be completed by the Department if Form G-79 has been

the Department on or before March 15, 2013 in order to obtain

properly completed by the taxpayer. Upon completion of Part II,

certification from the Department. Failure to comply with the fore-

the Department will mail the certified Form G-79 to the taxpayer at

going provision shall constitute a waiver of the right to claim the

the mailing address listed on the form.

exemption. No extensions for filing Form G-79 for certification will

be allowed. The Department will certify the maximum exemption

How to Claim the Exemption

amount that may be claimed by the taxpayer who submits Form

G-79 for certification based on the taxpayer’s proportionate share

Report the exemption on Form G-49 in part II, column (b) and on

of the exemption under HRS §237-24.7(1) subject to the $400,000

Schedule GE (Form G-45/G-49). The amount of the exemption

tax cap.

claimed cannot exceed the amount allocated to the taxpayer by

the Department on the certified Form G-79. Schedule GE (Form

Amending Form G-79. If you submit Form G-79 for certification

G-45/G-49) and the certified Form G-79 must be attached to and

and later become aware of any changes to the information report-

filed with the annual general excise/use tax return (Form G-49).

ed, file an amended Form G-79. Write “Amended” at the top of

Failure to attach the required attachments and/or claiming a ex-

Form G-79 to indicate it is an amended Form G-79. Form G-79,

emption that exceeds the maximum allowable exemption amount

including amendments, will not be accepted after March 15, 2013.

may result in the disallowance of the exemption, in whole or in

Claiming the Exemption. Report the amount of the exemption on

part. Taxpayers claiming this exemption may not file Form G-49

Form G-49 and Schedule GE (Form G-45/G-49). File Form G-49,

electronically.

Schedule GE (Form G-45/G-49), and your certified Form G-79 on

For Fiscal Year Taxpayers

or before the due date (including extensions) for filing Form G-49.

Form G-49 is due on or before the 20th day of the 4th month fol-

Please see Tax Information Release No. 2010-08 for information

lowing the close of the tax year.

on when the exemption may be claimed.

Where to File

To obtain certification, file Form G-79 with:

Rules Office

Hawaii Department of Taxation

P.O. Box 259

Honolulu, HI 96809-0259

FORM G-79

1

1 2

2