INSTRUCTION

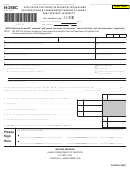

STATE OF HAWAII — DEPARTMENT OF TAXATION

Instructions for Form N-288B

FORM N-288B

(REV. 2014)

Application for Withholding Certificate for Dispositions by

Nonresident Persons of Hawaii Real Property Interest

NOTE: References to “taxpayer and spouse”, “married”, “unmarried”, also means “partners in a civil

union”, “in a civil union”, and “not in a civil union”, respectively.)

General Instructions

transfer. Forms N-288B filed later than 10 work-

NOTE: The transferor/seller is required under

ing days prior to the date of transfer will not be

section 235-92, HRS, to file an income tax

Purpose of Form

accepted and will be returned to the transferor/

return whether or not the person derives a

seller. The Department of Taxation will not ap-

taxable gain.

Use Form N-288B to apply for a withholding cer-

prove Forms N-288B after the date of transfer

Line 6. If the property was used as a rental

tificate to waive or adjust withholding on disposi-

reported on Line 4a has passed. Timely mailing

tions by nonresident persons of Hawaii real prop-

property at anytime by the transferor/seller(s),

of Form N-288B by U.S. mail or any delivery ser-

erty interest. Use this form only for applications

check the box marked “yes” and fill in the appropri-

vice designated for purposes of section 7502 of

based on (1) a claim that the transferor/seller will

ate Hawaii Tax I.D. Number. If not, check the box

the federal Internal Revenue Code will be treated

not realize any gain with respect to the transfer, or

marked “no”.

as timely filed. See Tax Information Release No.

(2) a claim that there will be insufficient proceeds

97-3 for more information.

Back of Copy A

to pay the withholding required under section

235-68(b), Hawaii Revised Statutes (HRS), after

Where to Send Form N-288B

Line 5a(1). Enter the gross sales price from the

payment of all costs, including selling expenses

sale. Attach a copy of a tentative statement from

Copies A and B of Form N-288B must be

and the amount of any mortgage or lien secured

your escrow company for this transaction showing

by the property. If a nonresident transferor/seller

mailed or hand delivered to the taxation district

the gross sales price, the transferor(s)/seller(s),

transfers two or more Hawaii real property inter-

office listed below which is located in the county

and the transferee(s)/buyer(s).

ests, one Form N-288B should be filed for each

where the closing of the sale is taking place, or the

Line 5a(2). In general, the cost or adjusted ba-

property transferred.

county in which the property is located. After the

sis is the cost of the property plus purchase com-

form has been approved or disapproved, copy B

Who Can Apply for a Withholding

missions and improvements, minus depreciation

of Form N-288B will be returned to the transferor/

Certificate

(if applicable). Increase the cost or other basis by

seller at the address specified on Line 1. If copy

any expense of sale, such as commissions and

B of Form N-288B is not submitted, a copy of the

The transferor/seller can file Form N-288B. If

state transfer taxes. Attach a copy of your closing

form will not be returned to the transferor/seller.

two or more nonresident transferors/sellers jointly

escrow statement from your purchase or acquisi-

The Department does not fax any confidential in-

transfer a Hawaii real property interest, a separate

tion of this property, invoices for improvements,

formation in regards to Form N-288B, nor does the

Form N-288B should be filed for each nonresident

depreciation schedules, and any other evidence

Department accept Form N-288B through fax.

transferor/seller applying for a withholding certifi-

of the basis of the property.

cate. One Form N-288B should be filed for a tax-

Specific Instructions

Line 5a(3). If the sale of the property was your

payer and spouse if they will be filing a joint return

main home and you qualify to exclude the entire

for the year in which they transferred their Hawaii

Line 2. Enter “Same as line 1” unless you are

gain, use Form N-103 as a worksheet. If you qual-

real property interest.

ify to exclude the entire gain (line 22 is zero (0)

entering another address.

If you entered a mail-

ing address on line 1 that is not your actual ad-

or less) attach worksheet to Form N-288B. Oth-

Withholding Certificate

dress, enter your actual address on line 2. If there

erwise, you DO NOT qualify for a waiver. Do not

Upon receipt of Form N-288B, the State of Ha-

are multiple transferor/sellers, attach additional

submit Form N-288B.

waii, Department of Taxation (Department) shall

sheets giving the required information about each

Line 5b(1a). Enter the gross sales price from the

determine whether the transferor/seller has re-

one, indicating ownership percentage and resi-

sale. Attach a copy of a tentative statement from

alized or will realize any gain with respect to the

dency status.

your escrow company for this transaction showing

transfer, or whether there will be insufficient pro-

Line 3. Enter the name, address, and iden-

the distribution of funds received, the transferor(s)/

ceeds to pay the withholding. After the form has

tification number (last 4 numbers of the SSN or

seller(s), and the transferee(s)/buyer(s).

been approved or disapproved, a copy of the form

FEIN), if any, of the transferee/buyer. The Internal

Line 5b(1b). Enter the amount of sales pro-

will be returned to the transferor/seller, who shall

Revenue Service (IRS) issues Individual Taxpayer

thereafter transmit the form to the transferee/buyer.

ceeds to be received in forms other than cash,

Identification Numbers (ITINs) to certain aliens

such as an agreement of sale or purchase money

If the Department is satisfied that no gain will be

who are required to have a U. S. taxpayer identi-

mortgage.

realized, the Department will waive the withhold-

fication number but who do not have, and are not

Line 5b(2a). Enter any expense of sale, such

ing requirement and the transferee/buyer is not

eligible to obtain, a social security number. The

required to withhold any tax. The transferee/buyer

as commissions and state transfer taxes.

last 4 numbers of the ITIN issued by the IRS must

shall attach a copy of the Form N-288B to Forms

be used as the individual’s identification number. If

Line 5b(2c). Enter any other cost associated

N-288 and N-288A, which must still be filed with

the individual has applied for an ITIN but the IRS

with the sale of the property, such as liens secured

the Department.

has not yet issued the ITIN, write “Applied For”. If

by the property.

there are multiple transferee/buyers, attach addi-

If the Department is satisfied that there will be

tional sheets giving the required information about

Signature

insufficient proceeds to pay the withholding, the

each one.

Department will adjust the amount required to be

Form N-288B must be signed by an individual, a

Line 4. Enter the appropriate information. In

withheld and the transferee/buyer shall withhold

responsible corporate officer, a member or gener-

the adjusted amount and submit the payment,

4b, enter the address and description of the prop-

al partner of a partnership, or a trustee, executor,

Form N-288, Form N-288A, and Form N-288B to

erty. Include the tax map key number.

or other fiduciary of a trust or estate. If Form N-

the Department.

Line 5. If 5a is checked, 5a on the back of Copy

288B is being filed by a taxpayer and spouse, both

must sign the form. In addition, Form N-288B may

When to File Form N-288B

A must be completed. If 5b is checked, 5b on the

be signed by an authorized agent with a power of

back of Copy A must be completed.

Form N-288B must be filed with the Department

attorney.

no later than 10 working days prior to the date of

MAILING ADDRESSES

OAHU DISTRICT OFFICE

MAUI DISTRICT OFFICE

HAWAII DISTRICT OFFICE

KAUAI DISTRICT OFFICE

OFFICE AUDIT BRANCH - N-288B

RE: N-288B

RE: N-288B

RE: N-288B

P. O. BOX 259

54 S. HIGH STREET, #208

75 AUPUNI STREET, #101

3060 EIWA STREET, #105

HONOLULU, HAWAII 96809-0259

WAILUKU, HAWAII 96793-2198

HILO, HAWAII 96720-4245

LIHUE, HAWAII 96766-1889

(830 PUNCHBOWL STREET, #228)

808-984-8500

808-974-6321

808-274-3456

808-587-1644

1

1 2

2 3

3 4

4