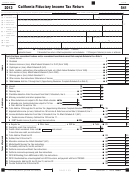

IT-205 (2013) (back)

Submit a copy of federal Schedule K-1 (Form 1041) for each beneficiary.

Schedule A – Details of federal taxable income of a fiduciary of a resident estate or trust

Enter items as reported for federal tax purposes or submit federal Form 1041.

.

43 Interest income .............................................................................................. 43

00

.

44 Dividends ....................................................................................................... 44

00

.

45

00

45 Business income (or loss)

(submit copy of federal Schedule C or C-EZ, Form 1040)

.

................. 46

46 Capital gain (or loss)

00

(submit copy of federal Schedule D, Form 1041)

47 Rents, royalties, partnerships, other estates and trusts (

submit copy of

.

....................................................................... 47

00

federal Schedule E, Form 1040)

.

................ 48

00

48 Farm income (or loss)

(submit copy of federal Schedule F, Form 1040)

.

................................. 49

00

49 Ordinary gain (or loss)

(submit copy of federal Form 4797)

.

............................................................... 50

00

50 Other income

(state nature of income)

.

51 Total income

........... 51

(add lines 43 through 50; enter here and on front page, line A)

00

.

52 Interest .......................................................................................................... 52

00

.

53 Taxes ............................................................................................................. 53

00

.

54 Fiduciary fees ................................................................................................ 54

00

.

55 Charitable deduction ..................................................................................... 55

00

.

56 Attorney, accountant, and return preparer fees ............................................. 56

00

.

57 Other deductions

............................................. 57

(itemize on an additional sheet)

00

58 Income distribution deduction

(submit copy of federal

for each beneficiary)

.

,

............................................... 58

Schedules K-1, Form 1041

00

.

59 Estate tax deduction

........................................................ 59

(submit computation)

00

.

60 Exemption (federal) ....................................................................................... 60

00

.

61 Total

........................................................................... 61

(add lines 52 through 60)

00

62 Federal taxable income of fiduciary

.

(subtract line 61 from line 51; enter here and on front page, line 1)

62

00

Schedule B – New York fiduciary adjustment of a resident or a nonresident estate or trust or a part-year resident trust

.

63 Interest income on state and local bonds other than New York

63

(gross amount not included in federal income) ..

00

64 Income taxes deducted on federal fiduciary return

.

........................................... 64

(see instructions)

00

(see instructions) Identify:

.

65 Other

...... 65

00

.

66 Total additions

....................................................................................... 66

(add lines 63, 64, and 65)

00

.

67 Interest income on US obligations included in federal income

67

00

(see inst.) Identify:

.

68 Other

... 68

00

........................................................................................ 69

.

69 Total subtractions

(add lines 67 and 68)

00

70 New York fiduciary adjustment

.

.. 70

(difference between lines 66 and 69 to be entered as total of column 5 below)

00

Schedule C – Shares of New York fiduciary adjustment of a resident or a nonresident estate or trust or a part-year resident trust

Submit additional sheets if necessary.

2 Identifying number

Shares of federal distributable

5

Shares of

of each beneficiary

net income (see instructions)

New York

Name and address of each beneficiary.

New York

Yonkers

fiduciary

1

Check box if beneficiary is a nonresident of:

3 Amount

4 Percent

State

adjustment

.

.

(a)

00

00

.

.

(b)

00

00

.

.

The total of Schedule C, column 5, should be the same as Schedule B, line 70 above.

Fiduciary

00

00

.

.

(see instructions)

Totals

00

100%

00

A If inter vivos trust, enter name and address of grantor:

B If revocable trust which changed state or city residence during the year, enter the date of the change of residence (see instr., page 2):

C Resident status – mark an X in all boxes that apply:

(3)

NYS full-year nonresident estate or trust

(6)

Yonkers full-year resident estate or trust

(1)

NYS full-year resident estate or trust

(4)

NYC full-year resident estate or trust

(7)

Yonkers part-year resident trust

(2)

NYS part-year resident trust

(5)

NYC part-year resident trust

(8)

Yonkers full-year nonresident estate or trust

D If an estate, indicate last known address of decedent

E Nonresident estate - indicate state of residency

F Submit a list of executors or trustees with their addresses and identification numbers (SSN or EIN).

G If a grantor trust, enter the identification number (SSN or EIN) of the individual reporting the income/loss ..................

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

designee?

(see instr.)

(

)

Yes

E-mail:

No

Sign return here

Paid

Preparer’s signature

Preparer’s NYTPRIN

preparer

must

Signature of fiduciary or officer representing fiduciary

Firm’s name (or yours, if self-employed)

Preparer’s PTIN or SSN

complete

(see instr.)

Employer identification number

Daytime phone number

Address

Date

(

)

E-mail:

Date:

Self-employed?

1

1 2

2