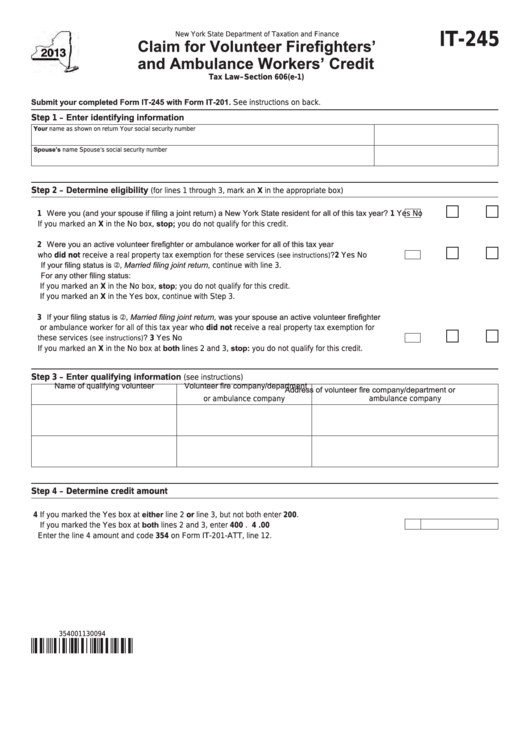

New York State Department of Taxation and Finance

IT-245

Claim for Volunteer Firefighters’

and Ambulance Workers’ Credit

Tax Law–Section 606(e-1)

Submit your completed Form IT-245 with Form IT-201. See instructions on back.

Enter identifying information

Step 1

–

Your name as shown on return

Your social security number

Spouse’s name

Spouse’s social security number

Determine eligibility

Step 2

–

(for lines 1 through 3, mark an X in the appropriate box)

1 Were you (and your spouse if filing a joint return) a New York State resident for all of this tax year? ......

1

Yes

No

If you marked an X in the No box, stop; you do not qualify for this credit.

2 Were you an active volunteer firefighter or ambulance worker for all of this tax year

? .......................

who did not receive a real property tax exemption for these services

2

Yes

No

(see instructions)

If your filing status is , Married filing joint return, continue with line 3.

For any other filing status:

If you marked an X in the No box, stop; you do not qualify for this credit.

If you marked an X in the Yes box, continue with Step 3.

3 If your filing status is , Married filing joint return, was your spouse an active volunteer firefighter

or ambulance worker for all of this tax year who did not receive a real property tax exemption for

? ............................................................................................................

these services

3

Yes

No

(see instructions)

If you marked an X in the No box at both lines 2 and 3, stop: you do not qualify for this credit.

Enter qualifying information

Step 3

–

(see instructions)

Name of qualifying volunteer

Volunteer fire company/department

Address of volunteer fire company/department or

or ambulance company

ambulance company

Step 4

Determine credit amount

–

4 If you marked the Yes box at either line 2 or line 3, but not both enter 200.

.

If you marked the Yes box at both lines 2 and 3, enter 400 . .................................................................

4

00

Enter the line 4 amount and code 354 on Form IT-201-ATT, line 12.

354001130094

1

1 2

2