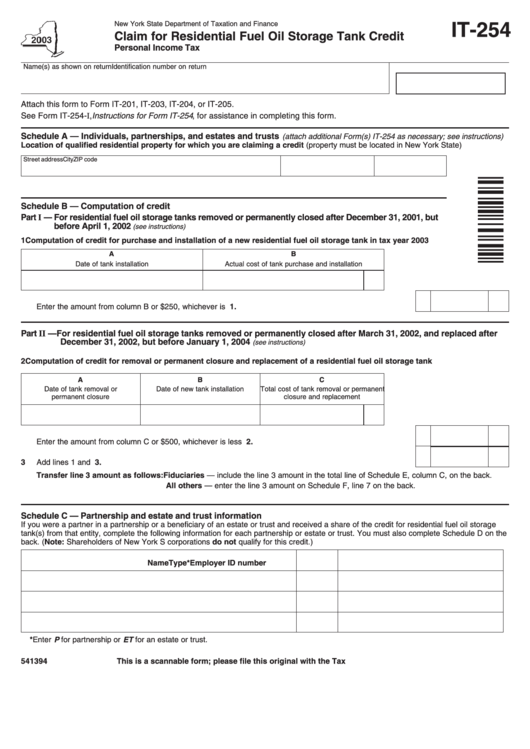

New York State Department of Taxation and Finance

IT-254

Claim for Residential Fuel Oil Storage Tank Credit

Personal Income Tax

Name(s) as shown on return

Identification number on return

Attach this form to Form IT-201, IT-203, IT-204, or IT-205.

See Form IT-254-I, Instructions for Form IT-254 , for assistance in completing this form.

Schedule A — Individuals, partnerships, and estates and trusts

(attach additional Form(s) IT-254 as necessary; see instructions)

Location of qualified residential property for which you are claiming a credit (property must be located in New York State)

Street address

City

ZIP code

Schedule B — Computation of credit

Part I — For residential fuel oil storage tanks removed or permanently closed after December 31, 2001, but

before April 1, 2002

(see instructions)

1 Computation of credit for purchase and installation of a new residential fuel oil storage tank in tax year 2003

A

B

Date of tank installation

Actual cost of tank purchase and installation

Enter the amount from column B or $250, whichever is less .............................................................................

1.

Part II — For residential fuel oil storage tanks removed or permanently closed after March 31, 2002, and replaced after

December 31, 2002, but before January 1, 2004

(see instructions)

2 Computation of credit for removal or permanent closure and replacement of a residential fuel oil storage tank

A

B

C

Date of tank removal or

Date of new tank installation

Total cost of tank removal or permanent

permanent closure

closure and replacement

Enter the amount from column C or $500, whichever is less .............................................................................

2.

3

Add lines 1 and 2 ................................................................................................................................................

3.

Transfer line 3 amount as follows: Fiduciaries — include the line 3 amount in the total line of Schedule E, column C, on the back.

All others — enter the line 3 amount on Schedule F, line 7 on the back.

Schedule C — Partnership and estate and trust information

If you were a partner in a partnership or a beneficiary of an estate or trust and received a share of the credit for residential fuel oil storage

tank(s) from that entity, complete the following information for each partnership or estate or trust. You must also complete Schedule D on the

back. (Note: Shareholders of New York S corporations do not qualify for this credit.)

Name

Type*

Employer ID number

*Enter P for partnership or ET for an estate or trust.

541394

This is a scannable form; please file this original with the Tax Department.

IT-254 2003

1

1 2

2