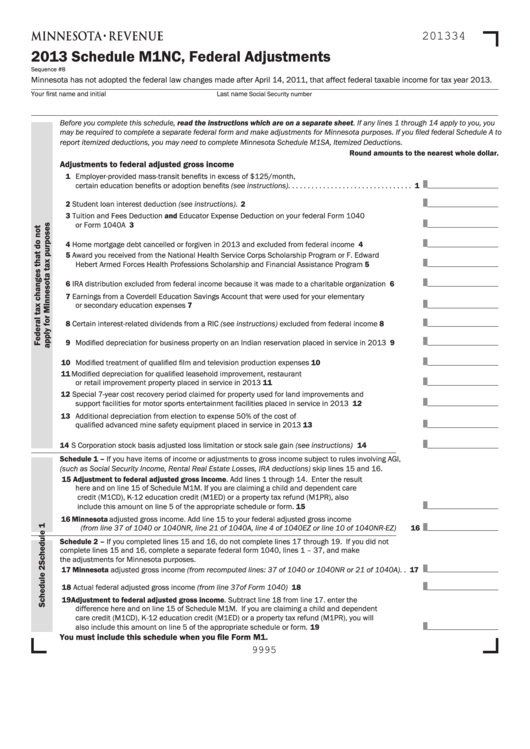

201334

2013 Schedule M1NC, Federal Adjustments

Sequence #8

Minnesota has not adopted the federal law changes made after April 14, 2011, that affect federal taxable income for tax year 2013.

Your first name and initial

Last name

Social Security number

Before you complete this schedule, read the instructions which are on a separate sheet. If any lines 1 through 14 apply to you, you

may be required to complete a separate federal form and make adjustments for Minnesota purposes. If you filed federal Schedule A to

report itemized deductions, you may need to complete Minnesota Schedule M1SA, Itemized Deductions.

Round amounts to the nearest whole dollar.

Adjustments to federal adjusted gross income

1 Employer-provided mass-transit benefits in excess of $125/month,

certain education benefits or adoption benefits (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Student loan interest deduction (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tuition and Fees Deduction and Educator Expense Deduction on your federal Form 1040

or Form 1040A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Home mortgage debt cancelled or forgiven in 2013 and excluded from federal income . . . . . . . . . . . . . 4

5 Award you received from the National Health Service Corps Scholarship Program or F. Edward

Hebert Armed Forces Health Professions Scholarship and Financial Assistance Program. . . . . . . . . . . . . 5

6 IRA distribution excluded from federal income because it was made to a charitable organization . . . . . 6

7 Earnings from a Coverdell Education Savings Account that were used for your elementary

or secondary education expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Certain interest-related dividends from a RIC (see instructions) excluded from federal income . . . . . . . . 8

9 Modified depreciation for business property on an Indian reservation placed in service in 2013 . . . . . . 9

10 Modified treatment of qualified film and television production expenses . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Modified depreciation for qualified leasehold improvement, restaurant

or retail improvement property placed in service in 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Special 7-year cost recovery period claimed for property used for land improvements and

support facilities for motor sports entertainment facilities placed in service in 2013 . . . . . . . . . . . . . . . 12

13 Additional depreciation from election to expense 50% of the cost of

qualified advanced mine safety equipment placed in service in 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 S Corporation stock basis adjusted loss limitation or stock sale gain (see instructions) . . . . . . . . . . . . . 14

Schedule 1 – If you have items of income or adjustments to gross income subject to rules involving AGI,

(such as Social Security Income, Rental Real Estate Losses, IRA deductions) skip lines 15 and 16.

15 Adjustment to federal adjusted gross income. Add lines 1 through 14. Enter the result

here and on line 15 of Schedule M1M. If you are claiming a child and dependent care

credit (M1CD), K-12 education credit (M1ED) or a property tax refund (M1PR), also

include this amount on line 5 of the appropriate schedule or form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Minnesota adjusted gross income. Add line 15 to your federal adjusted gross income

(from line 37 of 1040 or 1040NR, line 21 of 1040A, line 4 of 1040EZ or line 10 of 1040NR-EZ) . . . . . 16

Schedule 2 – If you completed lines 15 and 16, do not complete lines 17 through 19. If you did not

complete lines 15 and 16, complete a separate federal form 1040, lines 1 – 37, and make

the adjustments for Minnesota purposes.

17 Minnesota adjusted gross income (from recomputed lines: 37 of 1040 or 1040NR or 21 of 1040A). . 17

18 Actual federal adjusted gross income (from line 37 of Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Adjustment to federal adjusted gross income. Subtract line 18 from line 17. enter the

difference here and on line 15 of Schedule M1M. If you are claiming a child and dependent

care credit (M1CD), K-12 education credit (M1ED) or a property tax refund (M1PR), you will

also include this amount on line 5 of the appropriate schedule or form.. . . . . . . . . . . . . . . . . . . . . . . . . . 19

You must include this schedule when you file Form M1.

9995

1

1 2

2 3

3 4

4