4 of 4

2013

Name

SSN

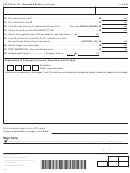

Form 1X

Page

Schedule 1

– Itemized Deduction Credit

(Fill in completely if any item is changed. If this credit was not claimed on your original return, enclose federal Schedule A.)

1 Medical and dental expenses from line 4 of federal Schedule A . . . . . . . . . . . . . . . . . . . . . . . .

1

.00

2 Interest paid from lines 10‑12 and 14 of federal Schedule A . Do not include interest paid

to purchase a second home located outside Wisconsin or a residence which is a boat .

.00

Also, do not include interest paid to purchase or hold U .S . government securities . . . . . . . . . .

2

3 Gifts to charity from line 19 of federal Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.00

4 Casualty losses from line 20 of federal Schedule A, only if the loss is directly related to

.00

a federally‑declared disaster . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.00

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.00

6 Wisconsin standard deduction from line 2 of Form 1X . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Subtract line 6 from line 5. If line 6 is more than line 5, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . .

.00

7

x

.05

8 Rate of credit is .05 (5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.00

9 Multiply line 7 by line 8 . Fill in here and on line 7 of Form 1X . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Schedule 2

– Married Couple Credit When Both Spouses Are Employed

(Fill in if changed.)

(A) Yourself

(B) Your spouse

1 Wages, salaries, tips, and other employee compensation .

Do NOT enter unearned income . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

.00

2 Net profit or (loss) from self-employment from federal

Schedules C, C‑EZ, and F

(Form 1040)

, Schedule K‑1

(Form 1065)

,

.00

.00

and any other taxable self‑employment or earned income . . . . . . . . 2

3 Combine lines 1 and 2 . This is earned income . . . . . . . . . . . . . . . . 3

.00

.00

4 Add the amounts from federal Form 1040, lines 24, 28 and 32,

plus repayment of supplemental unemployment benefits, and

contributions to secs . 403(b) and 501(c)(18) pension plans

included in line 36, and any Wisconsin disability income

exclusion . Fill in the total of these adjustments that apply to

.00

.00

your or your spouse’s income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3. This is qualified earned income.

If less than zero, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

.00

6 Fill in the smaller of column (A) or (B) of line 5. If more than $16,000, fill in $16,000

.00

6

x

.03

7 Rate of credit is .03 (3 .0%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Multiply line 6 by line 7 . Fill in here and on line 18 of Form 1X .

Do not fill in more than $480 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.00

1

1 2

2 3

3 4

4