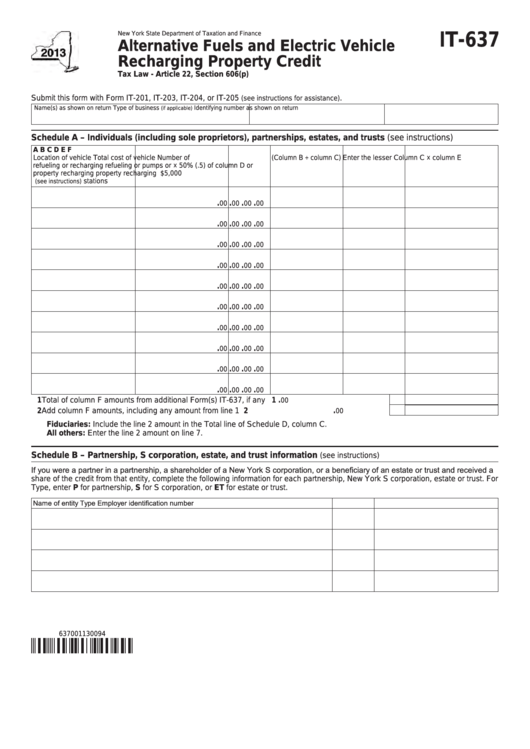

New York State Department of Taxation and Finance

IT-637

Alternative Fuels and Electric Vehicle

Recharging Property Credit

Tax Law - Article 22, Section 606(p)

Submit this form with Form IT-201, IT-203, IT-204, or IT-205

.

(see instructions for assistance)

Name(s) as shown on return

Type of business

Identifying number as shown on return

(if applicable)

Schedule A – Individuals (including sole proprietors), partnerships, estates, and trusts (see instructions)

A

B

C

D

E

F

Location of vehicle

Total cost of vehicle

Number of (Column B ÷ column C)

Enter the lesser

Column C × column E

refueling or recharging

refueling or

pumps or

× 50% (.5)

of column D or

property

recharging property

recharging

$5,000

stations

(see instructions)

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

.

.

.

00

00

00

00

.

1 Total of column F amounts from additional Form(s) IT-637, if any .....................................................

1

00

.

2 Add column F amounts, including any amount from line 1 .................................................................

2

00

Fiduciaries: Include the line 2 amount in the Total line of Schedule D, column C.

All others: Enter the line 2 amount on line 7.

Schedule B – Partnership, S corporation, estate, and trust information

(see instructions)

If you were a partner in a partnership, a shareholder of a New York S corporation, or a beneficiary of an estate or trust and received a

share of the credit from that entity, complete the following information for each partnership, New York S corporation, estate or trust. For

Type, enter P for partnership, S for S corporation, or ET for estate or trust.

Name of entity

Type

Employer identification number

637001130094

1

1 2

2