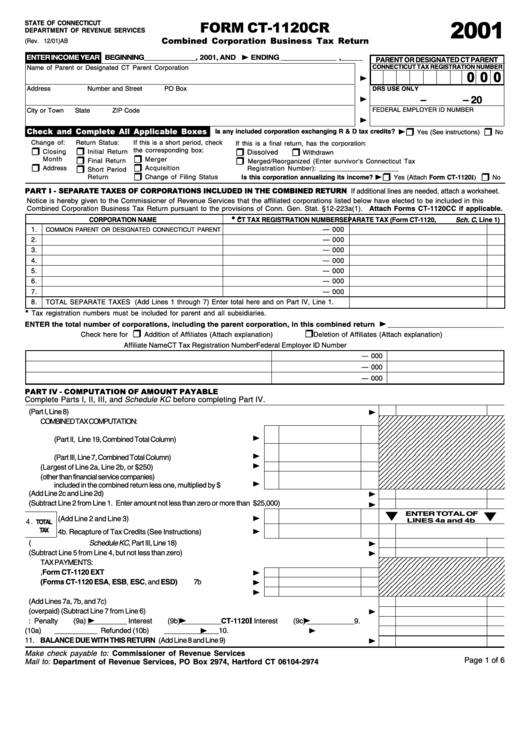

Form Ct-1120cr - Combined Corporation Business Tax Return - 2001

ADVERTISEMENT

2001

FORM CT-1120CR

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Combined Corporation Business Tax Return

(Rev. 12/01)AB

ENTER INCOME YEAR

BEGINNING ____________ , 2001, AND

ENDING _____________ , _____

PARENT OR DESIGNATED CT PARENT

CONNECTICUT TAX REGISTRATION NUMBER

Name of Parent or Designated CT Parent Corporation

0 0 0

Address

Number and Street

PO Box

DRS USE ONLY

–

– 20

FEDERAL EMPLOYER ID NUMBER

City or Town

State

ZIP Code

Check and Complete All Applicable Boxes

Is any included corporation exchanging R & D tax credits?

Yes (See instructions)

No

Change of:

Return Status:

If this is a short period, check

If this is a final return, has the corporation:

the corresponding box:

Closing

Initial Return

Dissolved

Withdrawn

Month

Merger

Final Return

Merged/Reorganized (Enter survivor’s Connecticut Tax

Address

Acquisition

Registration Number): _____________________

Short Period

Return

Change of Filing Status

Is this corporation annualizing its income?

Yes (Attach Form CT-1120I)

No

PART I - SEPARATE TAXES OF CORPORATIONS INCLUDED IN THE COMBINED RETURN If additional lines are needed, attach a worksheet.

Notice is hereby given to the Commissioner of Revenue Services that the affiliated corporations listed below have elected to be included in this

Combined Corporation Business Tax Return pursuant to the provisions of Conn. Gen. Stat. §12-223a(1).

Attach Forms CT-1120CC if applicable.

* * * * *

CORPORATION NAME

CT TAX REGISTRATION NUMBER

SEPARATE TAX (Form CT-1120, Sch. C , Line 1)

1.

— 000

COMMON PARENT OR DESIGNATED CONNECTICUT PARENT

2.

— 000

3.

— 000

4.

— 000

5.

— 000

6.

— 000

7.

— 000

8.

TOTAL SEPARATE TAXES (Add Lines 1 through 7) Enter total here and on Part IV, Line 1.

*

Tax registration numbers must be included for parent and all subsidiaries.

ENTER the total number of corporations, including the parent corporation, in this combined return

____________________________

Check here for

Addition of Affiliates (Attach explanation)

Deletion of Affiliates (Attach explanation)

Affiliate Name

CT Tax Registration Number

Federal Employer ID Number

— 000

— 000

— 000

PART IV - COMPUTATION OF AMOUNT PAYABLE

Complete Parts I, II, III, and Schedule KC before completing Part IV.

1. TOTAL SEPARATE TAXES (Part I, Line 8) .................................................................................................

1.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

COMBINED TAX COMPUTATION:

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

2a. Tax on Combined Net Income

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

(Part II, Line 19, Combined Total Column) ..................................

2a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

2b. Tax on Combined Minimum Tax Base

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

(Part III, Line 7, Combined Total Column) ....................................

2b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

2c. Tax (Largest of Line 2a, Line 2b, or $250) ................................

2c

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

2d. Tax on companies (other than financial service companies)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

included in the combined return less one, multiplied by $250 ......

2d

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

2. COMBINED TAX (Add Line 2c and Line 2d) ................................................................................................

2.

3. PREFERENCE TAX (Subtract Line 2 from Line 1. Enter amount not less than zero or more than $25,000) ....

3.

ENTER TOTAL OF

4a. Tax (Add Line 2 and Line 3) .............................................

4a

LINES 4a and 4b

4 .

TOTAL

TAX

4b. Recapture of Tax Credits (See Instructions) .....................

4b

4.

5. TAX CREDITS ( Schedule KC , Part III, Line 18) ............................................................................................

5.

6. BALANCE OF TAX PAYABLE (Subtract Line 5 from Line 4, but not less than zero) .....................................

6.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

TAX PAYMENTS:

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

7a. Paid with Application for Extension, Form CT-1120 EXT ..........

7a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

7b. Paid with Estimates (Forms CT-1120 ESA, ESB, ESC, and ESD)

7b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

7c. Overpayment from prior year ...................................................

7c

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

7. TOTAL TAX PAYMENTS (Add Lines 7a, 7b, and 7c) ..................................................................................

7.

8. BALANCE OF TAX DUE (overpaid) (Subtract Line 7 from Line 6) ................................................................

8.

9. Add: Penalty

(9a) __________ Interest

(9b) __________ CT-1120

I

Interest

(9c) ____________

9.

10. Amount to be credited to 2002 Estimated Tax (10a)

___________ Refunded (10b)

______________

10.

11. BALANCE DUE WITH THIS RETURN (Add Line 8 and Line 9) ....................................................................

11.

Make check payable to: Commissioner of Revenue Services

Page 1 of 6

Mail to: Department of Revenue Services, PO Box 2974, Hartford CT 06104-2974

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6