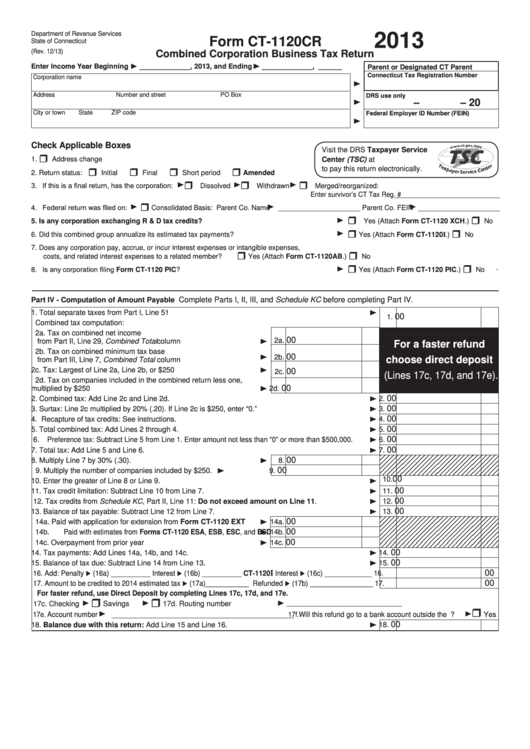

Form Ct-1120cr - Combined Corporation Business Tax Return - 2013

ADVERTISEMENT

Department of Revenue Services

2013

Form CT-1120CR

State of Connecticut

(Rev. 12/13)

Combined Corporation Business Tax Return

Enter Income Year Beginning

_____________ , 2013, and Ending

_____________ , ______

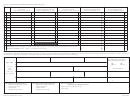

Parent or Designated CT Parent

Connecticut Tax Registration Number

Corporation name

Address

Number and street

PO Box

DRS use only

–

– 20

City or town

State

ZIP code

Federal Employer ID Number (FEIN)

Check Applicable Boxes

Visit the DRS Taxpayer Service

1.

Address change

Center (TSC) at

to pay this return electronically.

2. Return status:

Initial

Final

Short period

Amended

3. If this is a final return, has the corporation:

Dissolved

Withdrawn

Merged/reorganized:

Enter survivor’s CT Tax Reg. # ___________________________

4. Federal return was filed on:

Consolidated Basis: Parent Co. Name

_____________________ Parent Co. FEIN

_____________________

5. Is any corporation exchanging R & D tax credits? ..................................................................

Yes (Attach Form CT-1120 XCH.)

No

6. Did this combined group annualize its estimated tax payments? ..................................................

Yes (Attach Form CT-1120I.)

No

7. Does any corporation pay, accrue, or incur interest expenses or intangible expenses,

costs, and related interest expenses to a related member? ..........................................................

Yes (Attach Form CT-1120AB.)

No

8. Is any corporation filing Form CT-1120 PIC? ................................................................................

Yes (Attach Form CT-1120 PIC.)

No

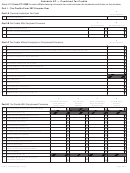

Complete Parts I, II, III, and Schedule KC before completing Part IV.

Part IV - Computation of Amount Payable

1. Total separate taxes from Part I, Line 51 ............................................................................................

00

1.

Combined tax computation:

2a. Tax on combined net income

00

2a.

from Part II, Line 29, Combined Total column ........................

For a faster refund

2b. Tax on combined minimum tax base

00

from Part III, Line 7, Combined Total column .........................

2b.

choose direct deposit

2c. Tax: Largest of Line 2a, Line 2b, or $250 ...............................

00

2c.

(Lines 17c, 17d, and 17e).

2d. Tax on companies included in the combined return less one,

00

multiplied by $250 ..................................................................

2d.

00

2. Combined tax: Add Line 2c and Line 2d. ............................................................................................

2.

00

3. Surtax: Line 2c multiplied by 20% (.20). If Line 2c is $250, enter “0.” ................................................

3.

00

4. Recapture of tax credits: See instructions. .........................................................................................

4.

00

5. Total combined tax: Add Lines 2 through 4. ........................................................................................

5.

00

6. Preference tax: Subtract Line 5 from Line 1. Enter amount not less than “0” or more than $500,000. .....

6.

00

7. Total tax: Add Line 5 and Line 6. .........................................................................................................

7.

00

8. Multiply Line 7 by 30% (.30). ............................................................

8.

00

................

9. Multiply the number of companies included by $250.

9.

00

10. Enter the greater of Line 8 or Line 9. ..................................................................................................

10.

00

11. Tax credit limitation: Subtract Line 10 from Line 7. .............................................................................

11.

00

12. Tax credits from Schedule KC, Part II, Line 11: Do not exceed amount on Line 11. .......................

12.

00

13. Balance of tax payable: Subtract Line 12 from Line 7. .......................................................................

13.

00

14a. Paid with application for extension from Form CT-1120 EXT

14a.

00

14b. Paid with estimates from Forms CT-1120 ESA, ESB, ESC, and ESD

14b.

00

14c. Overpayment from prior year

14c.

00

14. Tax payments: Add Lines 14a, 14b, and 14c. .....................................................................................

14.

00

15. Balance of tax due: Subtract Line 14 from Line 13. ............................................................................

15.

00

I

16. Add: Penalty

(16a) __________ Interest

(16b) __________ CT-1120

Interest

(16c) ____________

16.

00

17. Amount to be credited to 2014 estimated tax

(17a)___________ Refunded

(17b) ________________ 17.

For faster refund, use Direct Deposit by completing Lines 17c, 17d, and 17e.

__________________________

17c. Checking

Savings

17d. Routing number

17e. Account number

____________________________________________ 17f. Will this refund go to a bank account outside the U.S.?

Yes

00

18. Balance due with this return: Add Line 15 and Line 16. .................................................................

18.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7